# A tibble: 6 × 3

diam height volume

<dbl> <dbl> <dbl>

1 8.3 70 10.3

2 8.6 65 10.3

3 8.8 63 10.2

4 10.5 72 16.4

5 10.7 81 18.8

6 10.8 83 19.73 Multiple Linear Regression

3.1 Introduction

So far we have spent quite a bit of time understanding how linear regression works when we observe two variables, \(X\) and \(Y\), and we have \(X\) as our explanatory variable and \(Y\) as our response variable.

However, in many of these examples, we could in fact have recorded data for more than two variables. For example, for the cherry tree data we had volume as our response and diameter as the explanatory variable. This dataset actually contained another variable, the height of a tree.

Would this also make sense to include in our model? You might think that both these variables (height and diameter) would be important in understanding the volume of a tree, and so we would like to use both in our statistical model.

We can actually include two (or even more) explanatory variables in our model. Things get slightly more complicated than the previous setting, but most of the ideas we have seen before can be extended to allow this. However, when we have many variables there can be problems and it becomes much harder to understand the relationship between these variables and our response. The simple nature of the relationship when we only have one predictor variable is one of the big benefits of a simple linear regression model.

Similarly, even if we have many variables we could use in our model, it might not actually make sense to include them all, and an important task is identifying which variables are most “important”. We will see how to consider each of these problems later, but first we can consider a slightly different setting, somewhat similar to the transformations we saw before.

3.2 Polynomial Regression

Before we consider adding multiple explanatory variables, we can instead consider ways to capture non linear patterns.

Remember that a linear regression is of the form

\[ Y = \beta_0 + \beta_1 X +\epsilon \]

However, we could also include \(X^2\) in our model. Then we could write

\[ Y= \beta_0 + \beta_1 X +\beta_2 X^2 + \epsilon \]

A natural question to ask is whether this is a linear regression or not. It turns out that it is still a linear regression, because it is linear in the coefficients, which are \(\beta_0, \beta_1, \beta_2\). We are just taking non linear functions of the \(x\) variable, not of these coefficients.

We could also have tried the model

\[ Y_i = \beta_0 + \beta_1 \cos(X_i) + \beta_2 \sin(X_i) +\epsilon_i, \]

which is also a linear regression. For a model to be linear, we just need:

- The parameters/coefficients, the \(\beta\) terms, to be linear

- The errors, \(\epsilon\), to have mean 0

We will only consider polynomial regression here but much more complex models can be used too, which are beyond the scope of this class.

A polynomial regression model of order p is given by the equation

\[ Y = \beta_0 + \beta_1 X + \beta_2 X^2 + \ldots + \beta_p X^p + \epsilon. \]

Here we could have \(p=1\), which is the standard linear regression model we saw before, or a larger value of \(p\). We will still make the same assumptions that the data \((x_i, y_i)\) are all independent and that the errors \(\epsilon_i\) all come from a normal distribution with fixed variance \(\sigma^2\), and are all independent. We call p the degree of the polynomial.

Example

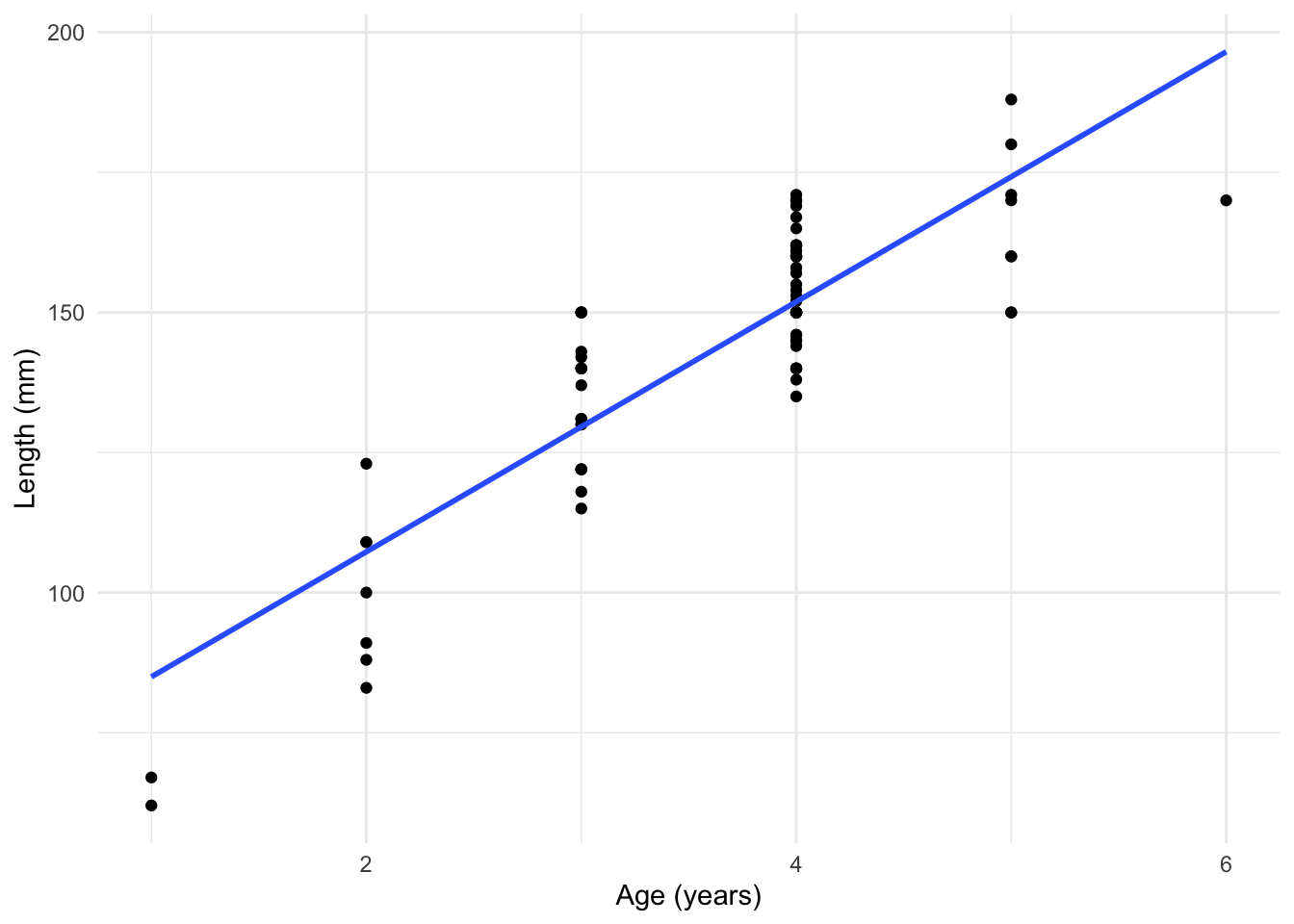

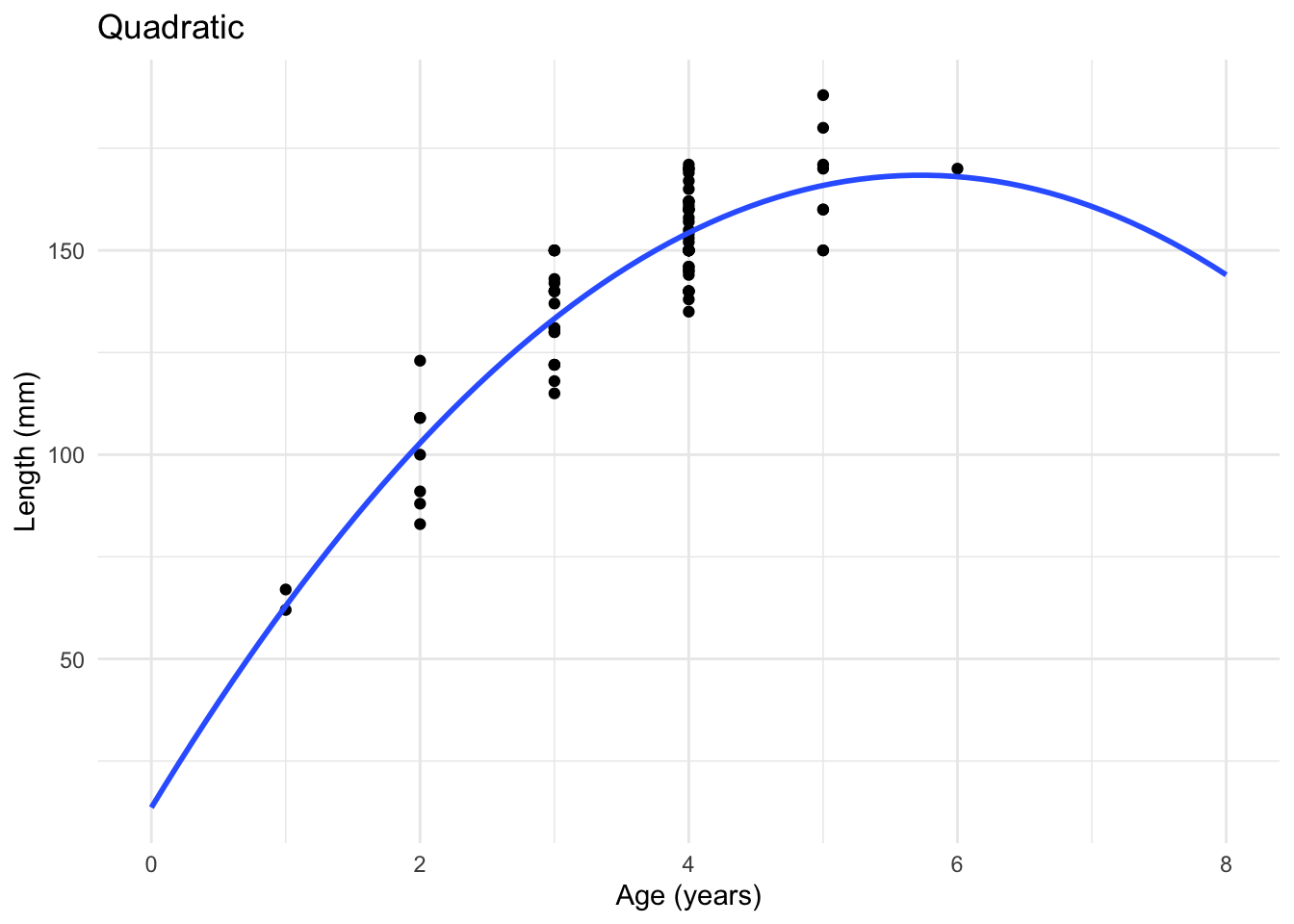

To see this, lets consider a simple example. We collect a sample of fish and record their age and their length. Fitting a regular linear regression is not that appropriate for the type of data we have here, as can be seen below.

Fitting a Polynomial Model

We can actually fit this model in a very similar way to the original regression model. Just as importantly, we can use very similar R code to fit it in practice. For this example, we fit a quadratic model, so that

\[ Y = \beta_0 + \beta_1 X + \beta_2 X^2 + \epsilon. \]

We can fit this in R using the lm function once again. We need to make the use of age^2 as a separate covariate explicit here, and one way to do this is through the use of I around it. This gives us the same output as before, except now we get an additional row, corresponding to information about \(\hat{\beta}_2\), the estimate of the coefficient of \(X^2\).

fit_quad <- lm(length ~ age + I(age^2), data = fish_data)

summary(fit_quad)

Call:

lm(formula = length ~ age + I(age^2), data = fish_data)

Residuals:

Min 1Q Median 3Q Max

-19.846 -8.321 -1.137 6.698 22.098

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 13.622 11.016 1.237 0.22

age 54.049 6.489 8.330 2.81e-12 ***

I(age^2) -4.719 0.944 -4.999 3.67e-06 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 10.91 on 75 degrees of freedom

Multiple R-squared: 0.8011, Adjusted R-squared: 0.7958

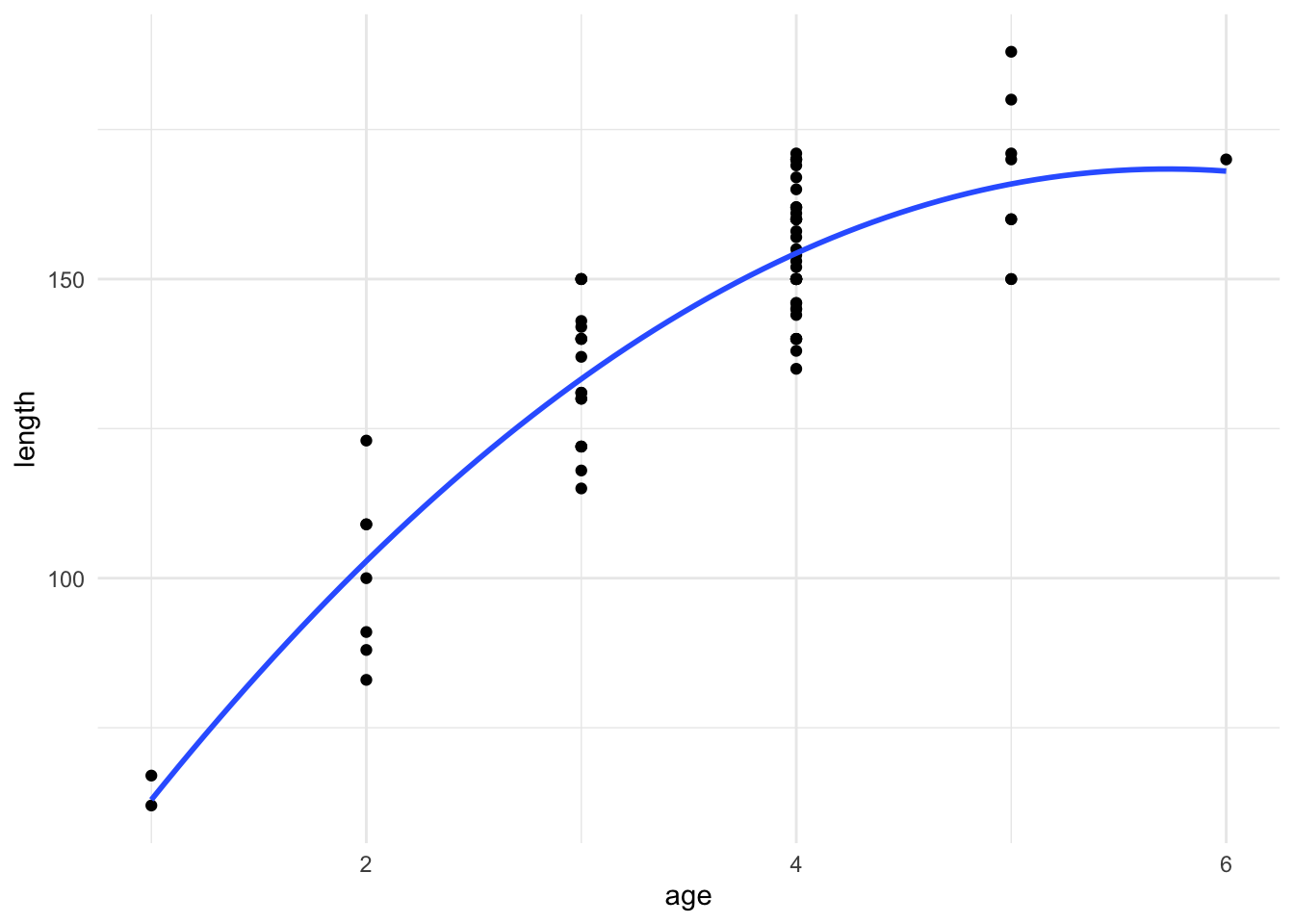

F-statistic: 151.1 on 2 and 75 DF, p-value: < 2.2e-16We can then plot this fitted model, and we see that this quadratic function seems to describe the data better than a simple straight line.

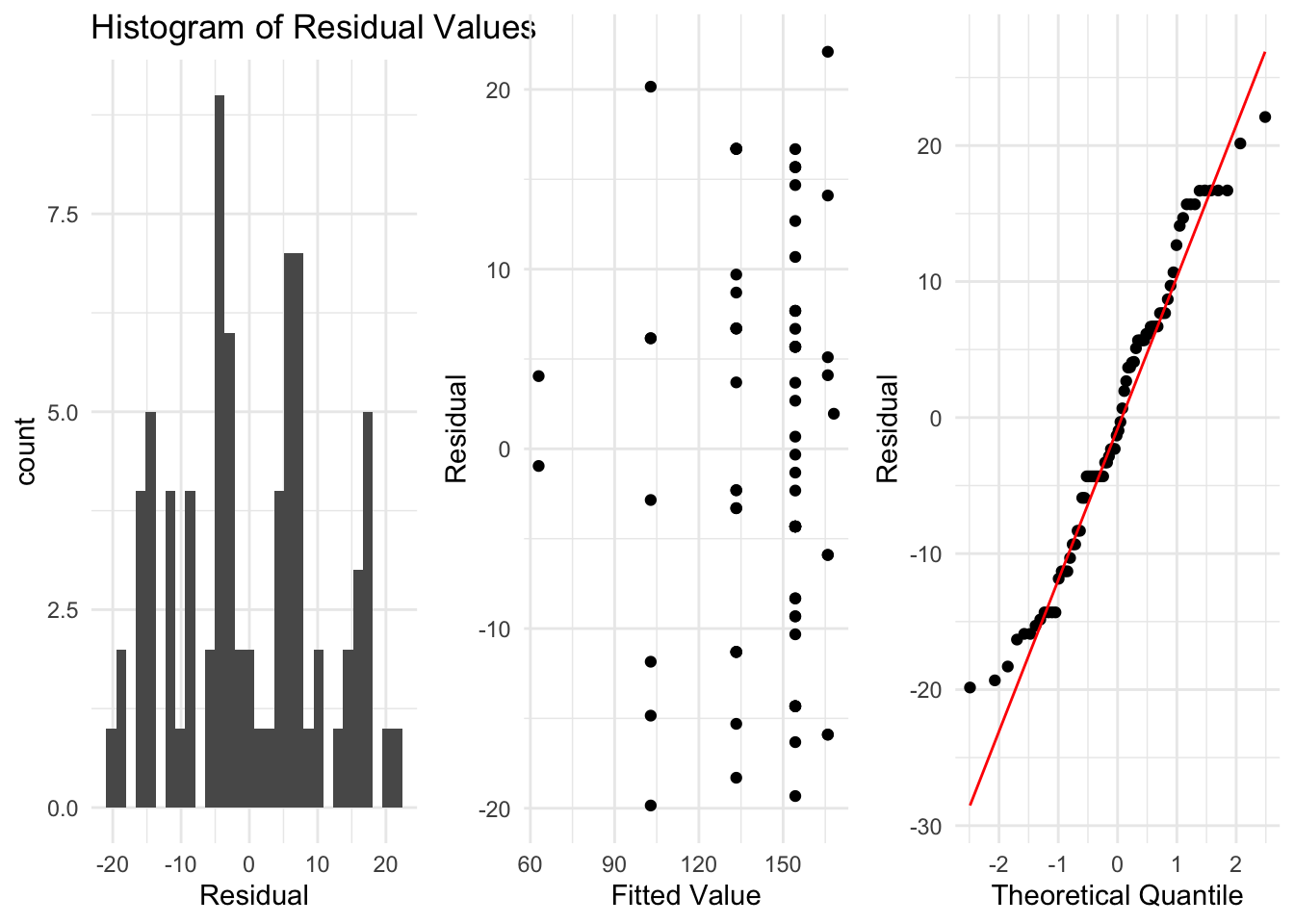

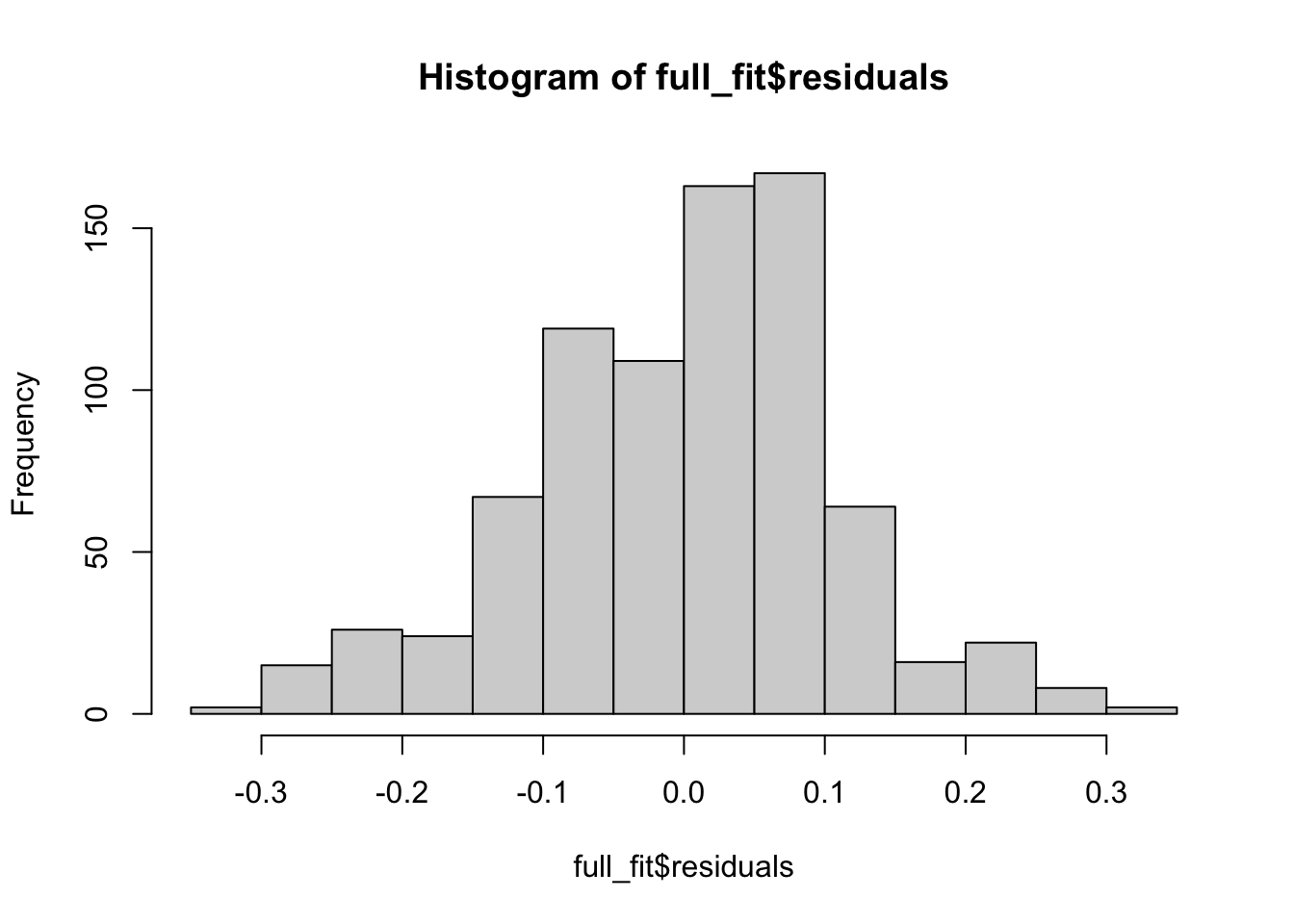

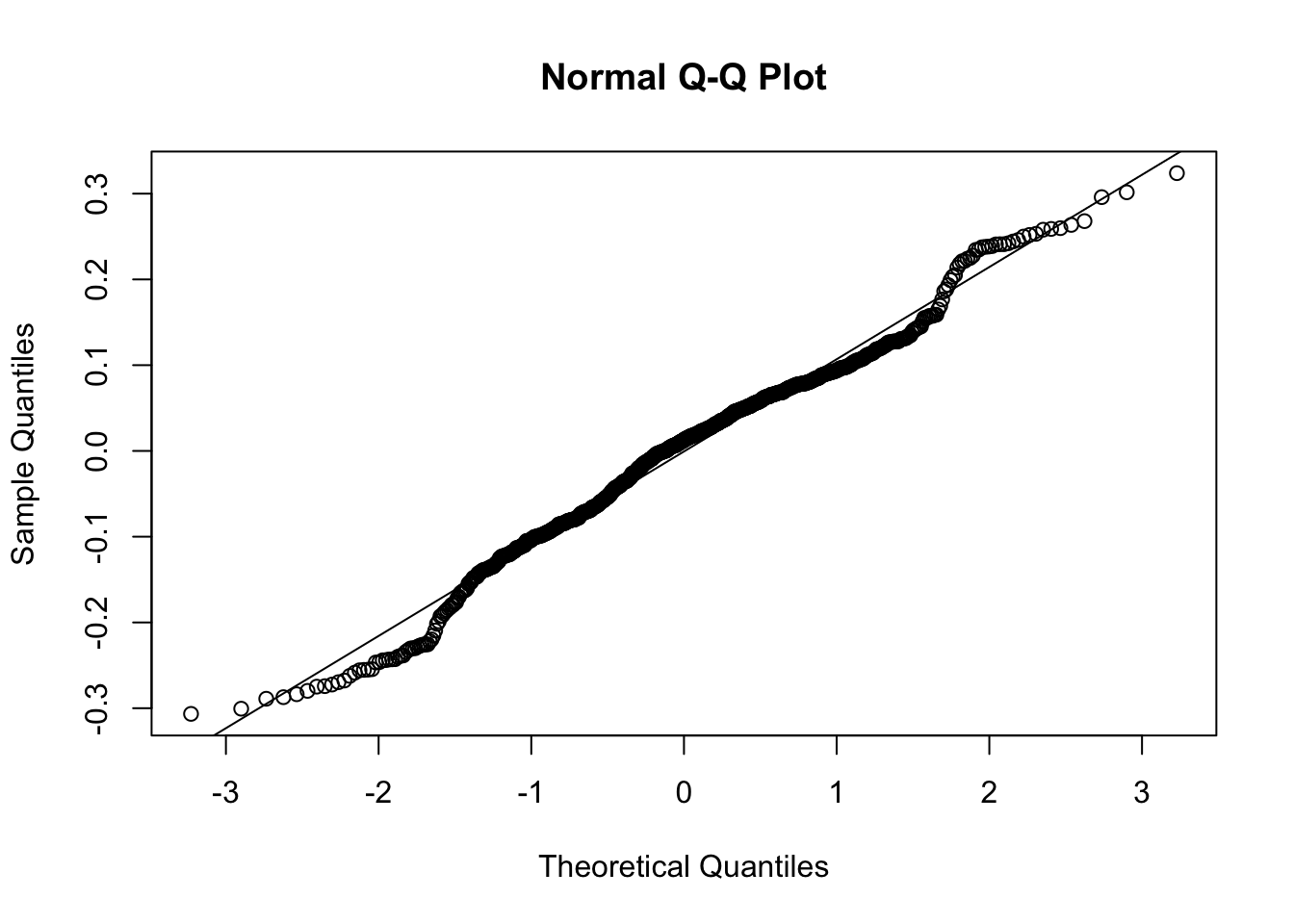

As before, we need to check the assumptions of our regression model before we interpret our results. These are the same assumptions as we saw for the simpler setting, and we can use the same R code to construct the plots.

Remember that we want to check:

- That the data is independent.

- That the residuals are normally distributed with mean 0, and some fixed variance which does not change as \(x\) changes.

These residuals look somewhat reasonable for this example now, and there are no clear problems which we should be worried about. So for this example, we can conclude the quadratic model is probably ok and we can move on to interpreting the output of the model.

Inference for a Polynomial Model

Given that we have fit a polynomial regression and decided it’s an appropriate model for our data, we can then interpret that model and investigate the estimated parameters, in much the same way we did this previously.

F-test for all slope coefficients \(=0\)

This is the first place where we can see how the ANOVA method we saw before gives us something different to the regular t test. Now we can use it to test something more complicated. For example, our proposed polynomial regression model is

\[ Y = \beta_0 + \beta_1 X + \beta_2 X^2 + \epsilon, \]

and now the F test can be used to test:

- \(H_0:\) That \(\beta_1 =\beta_2 = 0\)

- \(H_A:\) That at least one of \(\beta_1,\beta_2\neq 0\),

at some significance level \(\alpha\).

Recall that when we do a hypothesis test like this we look at the sums of squares in the model, and our test statistic is given by

\[ f = \frac{MSModel}{MSError}, \]

Where \(MSModel = SSModel/df_{M}\), with \(df_M\) the degrees of freedom of the model. This was 1 in Chapter 2 but will change now, depending on the order of the polynomial. Remember that

\[ SSTotal = SSModel + SSError, \]

and \(SSTotal\) has \(n-1\) degree of freedom, because we just estimate \(\bar{y}\). Now \(SSError\) has \(n-p-1\) degrees of freedom, because under the polynomial model of order \(p\), we estimate \(p+1\) parameters, \(\beta_0,\beta_1,\ldots, \beta_p\). Therefore the model term will have \(p\) degrees of freedom, and under the null hypothesis, \(f\) comes from an \(F\) distribution with \(p,n-p-1\) degrees of freedom, \(F_{p,n-p-1}\). The \(F\) distribution can only take on positive values, and we reject the null hypothesis if \(f\) is either very small (just above 0) or very large. As before we can compute explicit critical values for an \(F\) distribution, using df however now they are not symmetric and so qf(0.025, df1 = 1, df2 = 10, lower.tail = TRUE) and qf(0.025, df1 = 1, df2 = 10, lower.tail = FALSE) will not be related.

qf(0.025, df1 = 2, df2 = 75, lower.tail = TRUE)[1] 0.02532636qf(0.025, df1 = 2, df2 = 75, lower.tail = FALSE)[1] 3.876416In practice, it is convenient to just look at the \(p\)-value given in the output. For this example we have \(p=2\), and we can examine the \(p\)-value given in the summary output to decide whether to reject or fail to reject our null hypothesis.

summary(fit_quad)

Call:

lm(formula = length ~ age + I(age^2), data = fish_data)

Residuals:

Min 1Q Median 3Q Max

-19.846 -8.321 -1.137 6.698 22.098

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 13.622 11.016 1.237 0.22

age 54.049 6.489 8.330 2.81e-12 ***

I(age^2) -4.719 0.944 -4.999 3.67e-06 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 10.91 on 75 degrees of freedom

Multiple R-squared: 0.8011, Adjusted R-squared: 0.7958

F-statistic: 151.1 on 2 and 75 DF, p-value: < 2.2e-16For this test at \(\alpha = 0.05\), because this \(p\)-value is smaller than \(\alpha\), we reject the null hypothesis that \(\beta_1=\beta_2=0\) at \(\alpha =0.05\).

Test if highest order term is 0

While the previous section described how to test if any coefficients of \(X\) are statistically different from 0, perhaps more interesting would be understanding whether the highest order term is 0 or not. For example, if you fit a quadratic model,

\[ Y = \beta_0 +\beta_1 X + \beta_2 X^2 +\epsilon, \]

you might be interested in testing whether you need the quadratic \(X^2\) term, or if a standard linear regression (\(\beta_2=0\)) is sufficient.

We want to test if \(H_0:\beta_2 = 0\) vs \(H_A:\beta_2\neq 0\) at significance level \(\alpha\). We can do this in the exact same way as before. The test statistic is given by

\[ t = \frac{\hat{\beta}_2 - 0}{se(\hat{\beta}_2)}, \]

where we can get this test statistic and each term in it from summary. Under the null hypothesis that \(\beta_2 = 0\), then \(t\) follows a t distribution with \(n-p-1\) degrees of freedom. As before, we get the p-value for this test for free from the output of summary.

We can also construct a confidence interval for \(\beta_2\), using the standard error in the output and looking up the corresponding t-score needed, with \(n-p-1\) degrees of freedom.

For this example we can see that the output tells us that a hypothesis test for \(\beta_2=0\) at \(\alpha = 0.01\) (for example) would reject the null hypothesis of this coefficient being zero.

We can do the same procedure for other coefficients, such as \(\beta_1\), however this is conditional on \(\beta_0\) and \(\beta_2\) being in the model.

How to choose p?

An important question when considering these polynomial models is the choice of \(p\). Why should we use \(p=2\) instead of \(p=4\), or even \(p=8\)?

Note that the \(F\) test will still test if all coefficients are zero or not, but it can become hard to determine how many coefficients you actually need. Using the \(p\)-values from summary also has potential problems. We will not go into in detail here, but essentially doing many t-tests (i.e, looking at all the \(p\)-values for each coefficient), can lead to major problems with your analysis.

Similarly, when you add more polynomials to your model, you make it more complicated, and it can lead to overfitting. Lets see this with an example. We will look at opinion poll data up to the democratic convention in the US in 2016 for two of the main candidates, Clinton and Sanders. We are interested in predicting how the opinion poll results will look for the following months. While you might have some (valid) concerns about using a regression model for time series data like this, it can often work well.

We will consider two potential models here:

A simple linear regression \(Y =\beta_0 + \beta_1 X + \epsilon\), where \(X\) is the date and \(Y\) is the share of the vote Clinton or Sanders receives.

A polynomial regression of order \(5\), given by \(Y = \beta_0 + \beta_1 X + \beta_2 X^2 +\beta_3 X^3 + \beta_4 X^4 +\beta_5 X^5 +\epsilon\), for the same \(X\) and \(Y\).

We can fit both of these models to this data.

When we look at the output of this fifth order polynomial model, the F test indicates that the hypothesis of all coefficients of \(X\) being 0 is rejected and several of the \(\beta\) coefficients are statistically significant.

## poly also fits a polynomial regression

summary(lm(Clinton ~ poly(Date,5), data = realclear[train, ]))

Call:

lm(formula = Clinton ~ poly(Date, 5), data = realclear[train,

])

Residuals:

Min 1Q Median 3Q Max

-17.8003 -3.1189 0.3729 3.7856 20.4931

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 57.0902 0.5333 107.059 < 2e-16 ***

poly(Date, 5)1 -49.8509 5.8900 -8.464 9.09e-14 ***

poly(Date, 5)2 -29.2684 5.8900 -4.969 2.34e-06 ***

poly(Date, 5)3 9.7054 5.8900 1.648 0.10211

poly(Date, 5)4 17.3707 5.8900 2.949 0.00385 **

poly(Date, 5)5 15.2980 5.8900 2.597 0.01061 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 5.89 on 116 degrees of freedom

Multiple R-squared: 0.4967, Adjusted R-squared: 0.475

F-statistic: 22.9 on 5 and 116 DF, p-value: 6.253e-16Which model would you suspect will do better at predicting the opinion polls in the next month? It appears that the polynomial model captures some trends in the data better than the simple regression model.

We can then show the next few opinion polls, along with the predictions from these two models.

The polynomial model overfits to the original data and is then not able to give good predictions for the new opinion polls. This means that it tries to make the model it fits match the data very closely (as it is a flexible model). If it turned out that the true model didn’t match the fitted model, this can lead to large errors, as we see here. Meanwhile, the simple regression model, while appearing to not fit the data as well, is actually more suited for making predictions for new data. This is because it cannot match the data in 2015 as closely.

It is quite common that more complicated models can appear to be better but when we actually evaluate them properly, such as for making predictions for new data, a less complex model can be more effective and also easier to understand. This is important to keep in mind as we continue looking at more complicated models.

Confidence Intervals for \(y\)

Much like the previous regression setting, we can also get confidence and prediction intervals for \(y\) at a new data point \(x_{new}\). The formulas for the standard errors are not shown here. The prediction intervals will be wider than the confidence intervals, by the same logic as we saw previously. For example, we can easily get 90% confidence and prediction intervals for \(x_{new}=4\). Because \(x_{new}^2\) can be computed directly from \(x_{new}\), you only need to specify the \(x\) variable, i.e the same variables we specified in the original fit of the model.

new_x <- data.frame(age = 4)

predict(fit_quad, newdata = new_x, interval = "confidence", level = 0.9) fit lwr upr

1 154.321 151.9609 156.681predict(fit_quad, newdata = new_x, interval = "prediction", level = 0.9) fit lwr upr

1 154.321 136.005 172.6369While this is all the time we will spend on polynomial regression models, the next version we consider, with multiple predictors, has many similarities.

3.3 Two Explanatory Variables

Much like the polynomial regression model, we can have two rather than one predictor variables in our model. Let’s consider this for the tree data, using the model

\[ Y = \beta_0 +\beta_1 X_1 + \beta_2 X_2 +\epsilon \]

For this example \(Y\) is the volume of a tree, \(X_1\) is the diameter and \(X_2\) is the height. That is, for tree \(i\) we observe the volume \(Y_i\), the diameter \(X_{{1}i}\) and the height \(X_{2i}\). We observe variables \(X_1\) and \(X_2\) for each row in our data. This is a linear regression and so we fit and check the conditions in the same way we did for our original regression models. However, we again need to be careful interpreting the terms in our model.

reg_fit <- lm(volume ~ diam + height, data = tree_data)

summary(reg_fit)

Call:

lm(formula = volume ~ diam + height, data = tree_data)

Residuals:

Min 1Q Median 3Q Max

-6.4065 -2.6493 -0.2876 2.2003 8.4847

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -57.9877 8.6382 -6.713 2.75e-07 ***

diam 4.7082 0.2643 17.816 < 2e-16 ***

height 0.3393 0.1302 2.607 0.0145 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 3.882 on 28 degrees of freedom

Multiple R-squared: 0.948, Adjusted R-squared: 0.9442

F-statistic: 255 on 2 and 28 DF, p-value: < 2.2e-16We can check the conditions for this regression model, by looking at the residuals, in the same way we did this before.

Here the residuals look to satisfy the normality assumptions well, indicating we can go on and interpret the results of our model.

One important point to note is that when we have this model with \(X_1\) and \(X_2\), how the residual standard deviation is calculated changes slightly. The formula for it is now

\[ \hat{\sigma}_e = \sqrt{\frac{\sum_{i=1}^{n}(y_i - \hat{y}_i)^2}{n -2 -1}}. \]

Note that the denominator has changed. We have 2 predictors here, \(X_1\) and \(X_2\) but we could have more. If we had \(p\) predictors \(X_1,X_2,\ldots,X_p\) then the model would be

\[ Y = \beta_0 + \beta_1 X_1 + \beta_2 X_2 + \ldots + \beta_p X_p +\epsilon \]

and the residual standard deviation would be given by

\[ \hat{\sigma}_e = \sqrt{\frac{\sum_{i=1}^{n}(y_i - \hat{y}_i)^2}{n - p -1}}. \]

This is the same formula we had with \(p=2\) predictors \(X_1\) and \(X_2\). We will discuss having more than \(p=2\) predictors later.

Inference

Given that this regression model looks reasonable, we can then interpret the estimated coefficients \(\hat{\beta}_0,\hat{\beta}_1,\hat{\beta}_2\). The interpretations are slightly different to before, and the differences are important.

For this model with \(X_1\) the diameter and \(X_2\) the height, then \(\hat{\beta}_0\) gives us the average \(y\) value when both \(x_1=0\) and \(x_2=0\). Like we saw before for other problems, this doesn’t really make sense for this data.

For interpreting \(\hat{\beta}_1\), this is then how much we expect the \(Y\) variable (volume) to change on average, when the diameter (\(X_1\)) increases by one unit, while the height (\(X_2\)) remains fixed.

For \(\hat{\beta}_2\), this is the average change in \(Y\) when \(X_2\) increases by one unit, while we leave the other variable \(X_1\) fixed.

In general, the coefficient \(\hat{\beta}_j\), for \(j=1\) or \(j=2\) here, tells you how the \(Y\) variable changes on average, when predictor \(X_j\) increases by one unit, while holding all other predictors constant. Similarly, we can use these estimates to get fitted values for specific values of the predictors, \(x_1\) and \(x_2\).

\[ \hat{y} = \hat{\beta}_0 + \hat{\beta}_1 x_1 + \hat{\beta}_2 x_2 \]

Note that we can’t as easily show the regression line now using a plot, because we have multiple \(x\) variables. Our “fitted line” is now a plane, where for each \(x_1\) and \(x_2\), we have a point on the plane which gives the corresponding fitted value of \(y\).

Testing and Confidence Intervals

As in the regression with one variable, we can do hypothesis tests and confidence intervals on the \(\beta\) coefficients.

Now the F test we saw before is used to test \(H_0:\beta_1=\beta_2 =0\) vs \(H_A:\) at least one \(\beta_1,\beta_2\neq 0\) at significance level \(\alpha\).

The test statistic \(f\) is

\[ f = \frac{MSModel}{MSError}, \]

which, under \(H_0\), follows an \(F\) distribution with \(2,n-2-1\) degrees of freedom. This is because we have \(p=2\) explanatory variables. For the tree data above, the summary function output is saved in summary(reg_fit). This tells us that for \(\alpha=0.05\) the p-value is smaller than \(\alpha\) and so we should reject \(H_0\) at significance level \(\alpha\).

We can also do hypothesis tests and confidence intervals for \(\beta_0,\beta_1\) and \(\beta_2\), using the summary output, which gives us the standard errors of each of these coefficients. To do these we need to specify the degrees of freedom of the t-distribution. This will have \(n-p-1\) degrees of freedom where \(p=2\) for this example.

For example, a 95% confidence interval for \(\beta_2\) would be given by

\[ \hat{\beta}_2 \pm t_{n-2-1, 0.05/2}se(\hat{\beta}_2), \] which for this example would be

\[ .3393 \pm 2.05\times .13 = (0.073, .605). \]

Since this confidence interval doesn’t contain 0, this is equivalent to doing the hypothesis test \(H_0:\beta_2 =0\) vs \(H_A:\beta_2\neq 0\) at \(\alpha = 0.05\) and rejecting the null hypothesis.

Again, when we have multiple \(X\) variables, we need to be careful about the interpretation of these results. Rejecting this \(H_0\) means there is evidence that there is a relationship between the height of a tree and its volume, while holding the diameter fixed.

We can also equivalently write this as evidence for a relationship between the height and the volume, after controlling for the diameter.

Confidence and Prediction Intervals for \(y\)

Finally, we can construct confidence and prediction intervals for \(y\), at specific values of \(x_1\) and \(x_2\). We will again have a slight change in the formulation of the standard errors we need for this, to account for the change in the number of variables.

If we want a confidence interval for the average value of \(y\) at a specific \(x_1^{new}\) and \(x_2^{new}\) then the standard error, \(S\) is more complicated. We will not give the formula here, but we can again use the predict function.

A \(100(1-\alpha)\%\) confidence interval will be of the form

\[ \left( \hat{\beta}_0 +\hat{\beta}_1 x_1^{new}+\hat{\beta}_2 x_2^{new} - t_{n-2-1,\alpha/2}S, \hat{\beta}_0 +\hat{\beta}_1 x_1^{new}+\hat{\beta}_2 x_2^{new} + t_{n-2-1,\alpha/2}S \right). \]

Similarly, a prediction interval will have standard error \(S^*\), where \(S^*\) is larger than \(S\), to reflect the additional uncertainty from estimating a specific point rather than the regression line. A \(100(1-\alpha)\%\) prediction interval is then given by

\[ \left( \hat{\beta}_0 +\hat{\beta}_1 x_1^{new}+\hat{\beta}_2 x_2^{new} - t_{n-2-1,\alpha/2}S^*, \hat{\beta}_0 +\hat{\beta}_1 x_1^{new}+\hat{\beta}_2 x_2^{new} + t_{n-2-1,\alpha/2}S^* \right). \]

Suppose for this example we are interested in a confidence interval for the average volume of a tree which has height 55ft and diameter 10 inches. We can compute this using predict and the fitted model.

new_data <- data.frame(diam = 10, height = 55)

predict(reg_fit, newdata = new_data,

interval = "confidence",

level = 0.95) fit lwr upr

1 7.752764 2.629077 12.87645Similarly, we could instead look at a prediction interval for the same values of \(x_1\) and \(x_2\). Note that this is wider and actually gives a negative lower end for the confidence interval. This value (the volume of a tree) cannot be negative so we can just replace it with 0.

predict(reg_fit, newdata = new_data,

interval = "prediction",

level = 0.95) fit lwr upr

1 7.752764 -1.706605 17.21213We can also fix the value of \(x_1\) and see how our predictions change as we change \(x_2\), and also how these predictions differ compared to the simpler model with only one variable, \(x_2\). Suppose we want to get a 90% confidence interval for the average volume of trees with a diameter of 12 inches but varying heights.

new_data <- data.frame(diam = 12, height = c(50, 55, 60))

predict(reg_fit, newdata = new_data,

interval = "confidence",

level = 0.9) fit lwr upr

1 15.47283 9.860002 21.08566

2 17.16909 12.627126 21.71104

3 18.86534 15.371639 22.35904What about if we got the same confidence interval for the regression with only height and not diameter. Would these confidence intervals be similar?

height_fit <- lm(volume ~ height, data = tree_data)

height_fit

Call:

lm(formula = volume ~ height, data = tree_data)

Coefficients:

(Intercept) height

-87.124 1.543 new_data <- data.frame(height = c(50, 55, 60))

predict(height_fit, newdata = new_data,

interval = "confidence",

level = 0.9) fit lwr upr

1 -9.956126 -27.400298 7.488046

2 -2.239377 -16.533618 12.054864

3 5.477372 -5.730775 16.685518Note that the estimated coefficients, and the corresponding confidence intervals are quite different now. This is because we have different models, one with the diameter as a predictor and one without it. Different models with the same data can give different interpretations. In practice, because both variables are important at predicting volume, we would expect the model containing both to give better predictions.

3.4 Extending to More Variables

What we saw in the previous section allowed for two explanatory (\(X\)) variables. As you might have guessed, there is no reason we can’t have even more variables.

If we have \(p\) explanatory variables then the regression formula would be given by

\[ Y = \beta_0 + \beta_1 X_1 +\beta_2 X_2 +\beta_3 X_3+\ldots\beta_p X_p+\epsilon. \]

As you can possibly imagine, everything that we did for the case with 2 \(X\) variables can now be used in this setting, instead now accounting for all the other variables in the model. Adding many variables can also lead to some new problems which we need to deal with when fitting these models also. We will discuss these problems below.

Example

Lets first see an example of adding several predictors, where we don’t have too many problems, and examine how we can interpret the results. Lets consider a dataset describing women who were tested for diabetes.

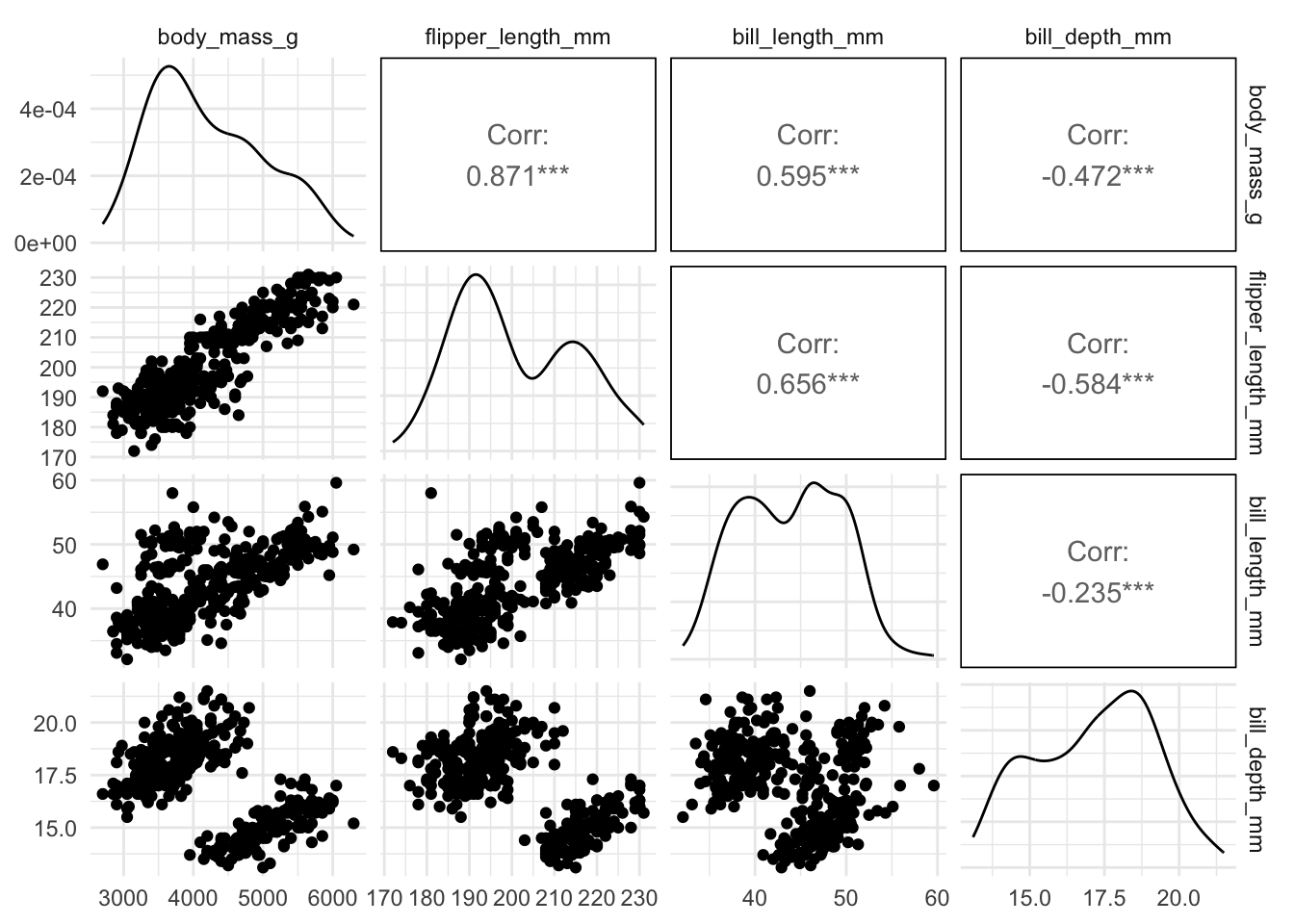

Our response variable will be glucose concentration, and our predictors will be blood pressure, BMI and skin fold thickness. Before fitting our regression model, we can examine the pairwise relationship between these variables using a function ggpairs which is in the R package GGally.

library(MASS) # to load the data

library(GGally)

ggpairs(Pima.te[, c("glu", "bp", "skin", "bmi")])

This plot shows a scatterplot of each pair of variables, along with the pairwise correlations. The diagonal plots are histograms of each variable separately. For this example, we see that there are some correlations between the variables, but they are generally not too strongly correlated. This is something we will come back to, as it can hinder our ability to fit a regression model.

We can then fit this multivariate regression with \(p=3\) predictors, given by

\[ Y = \beta_0 + \beta_1 X_1 +\beta_2 X_2 +\beta_3 X_3 +\epsilon, \]

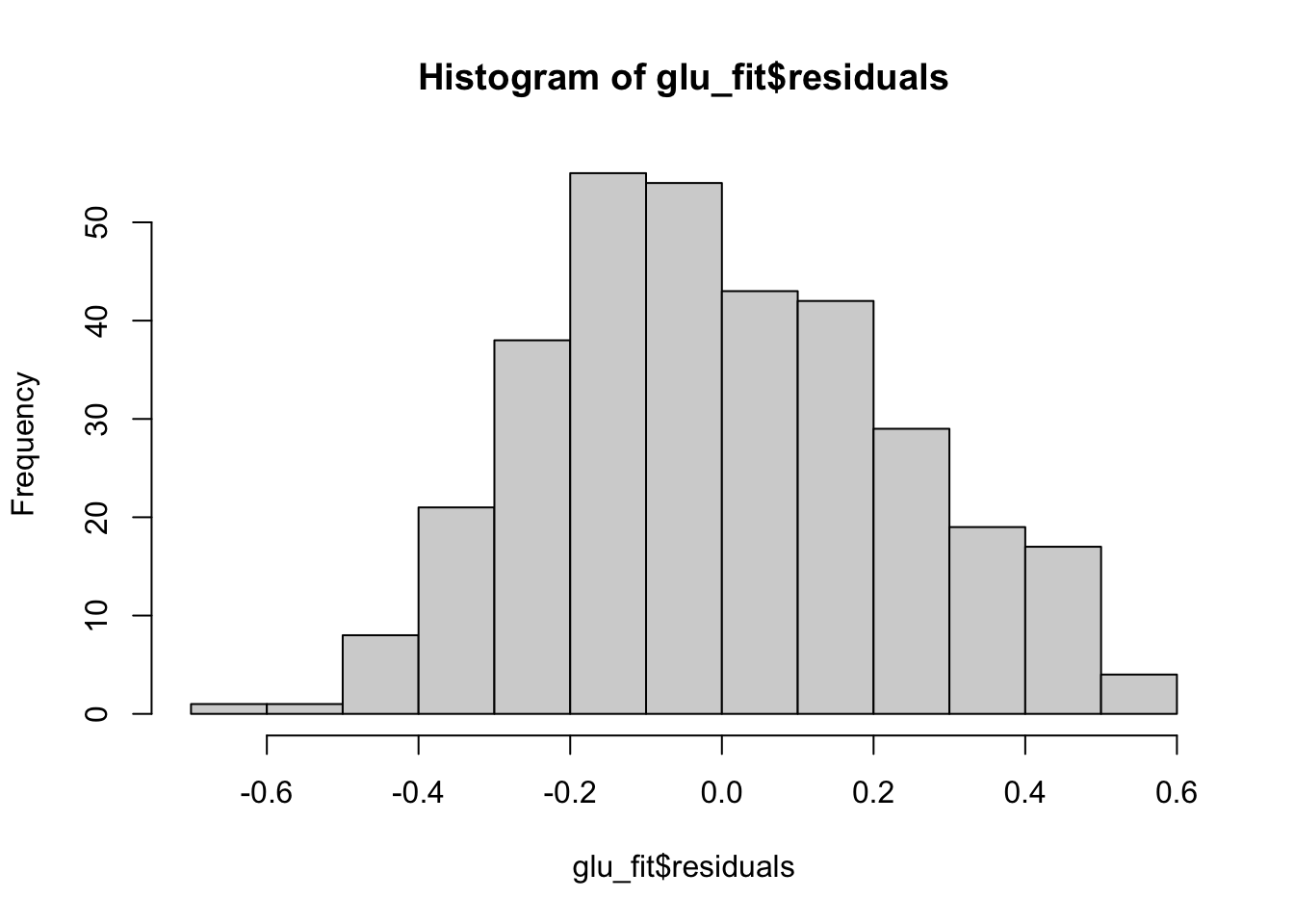

where as previously we can use the lm function in R. For this example, we will actually use log(Y), as we get residuals which look to satisfy all the assumptions we need quite well, as seen below.

glu_fit <- lm(log(glu) ~ bp + skin + bmi, data = Pima.te)

summary(glu_fit)

Call:

lm(formula = log(glu) ~ bp + skin + bmi, data = Pima.te)

Residuals:

Min 1Q Median 3Q Max

-0.6036 -0.1730 -0.0217 0.1669 0.5162

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 4.325618 0.082779 52.255 <2e-16 ***

bp 0.002318 0.001082 2.143 0.0329 *

skin 0.002985 0.001776 1.681 0.0938 .

bmi 0.005159 0.002472 2.087 0.0377 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.2369 on 328 degrees of freedom

Multiple R-squared: 0.09272, Adjusted R-squared: 0.08442

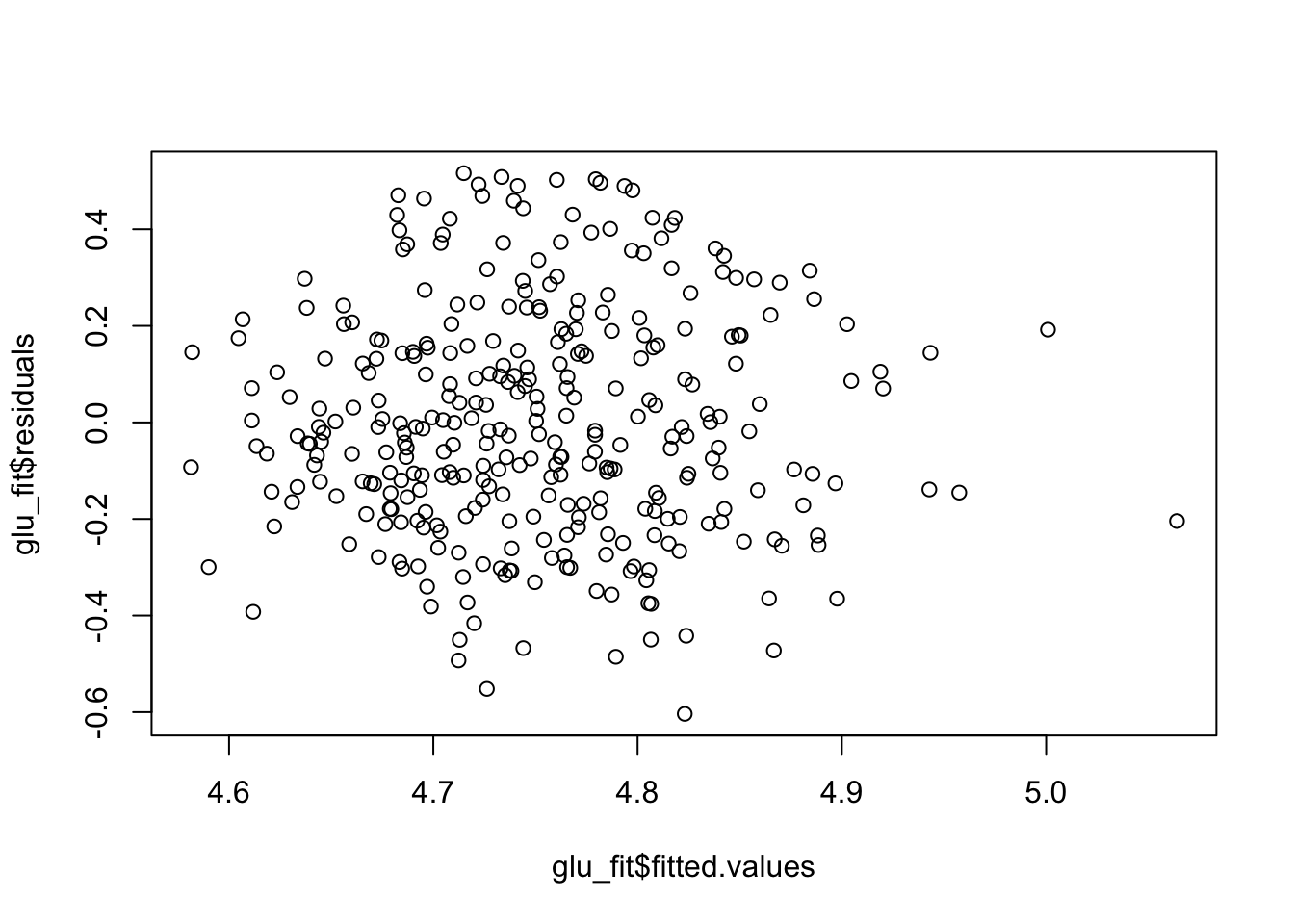

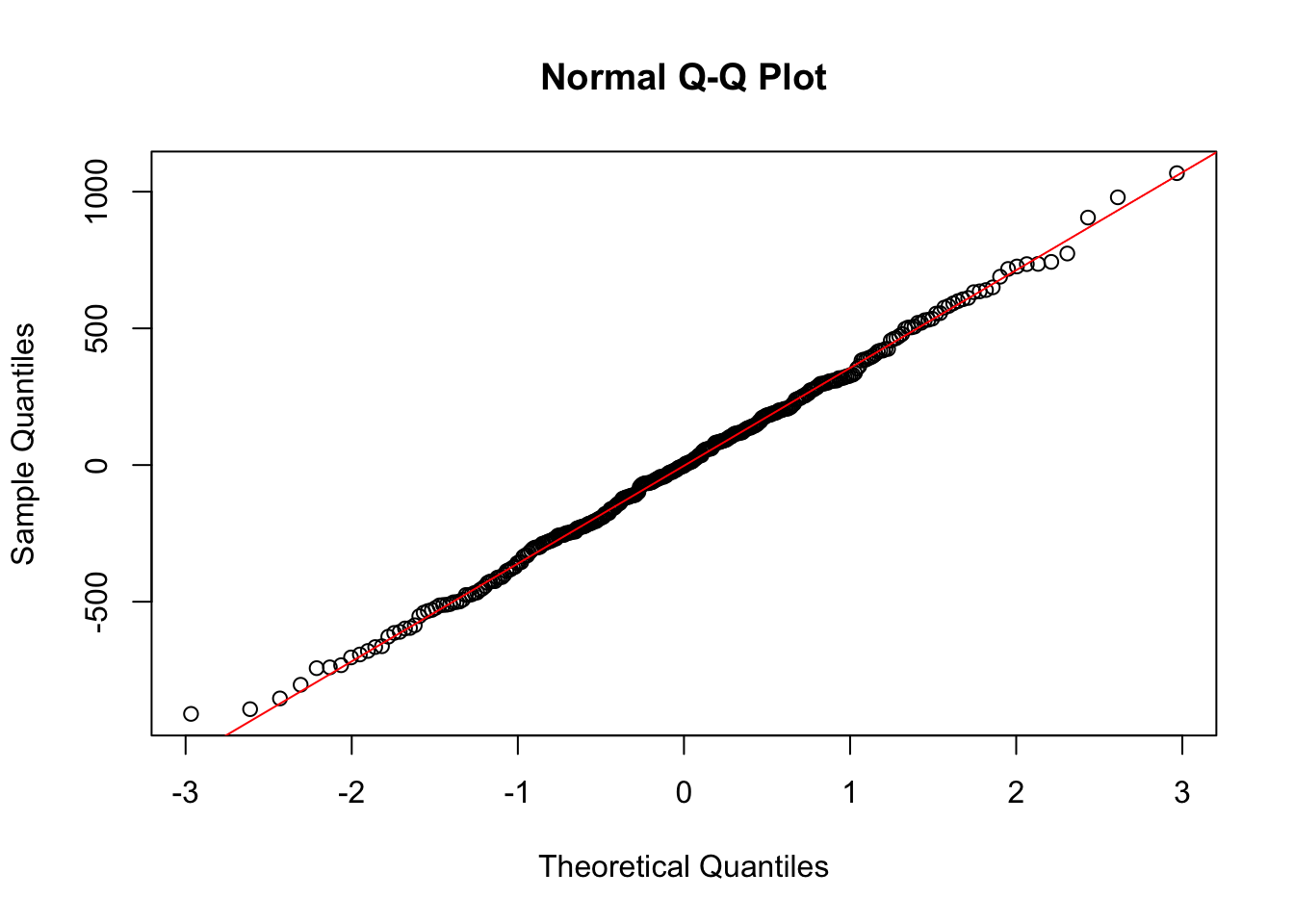

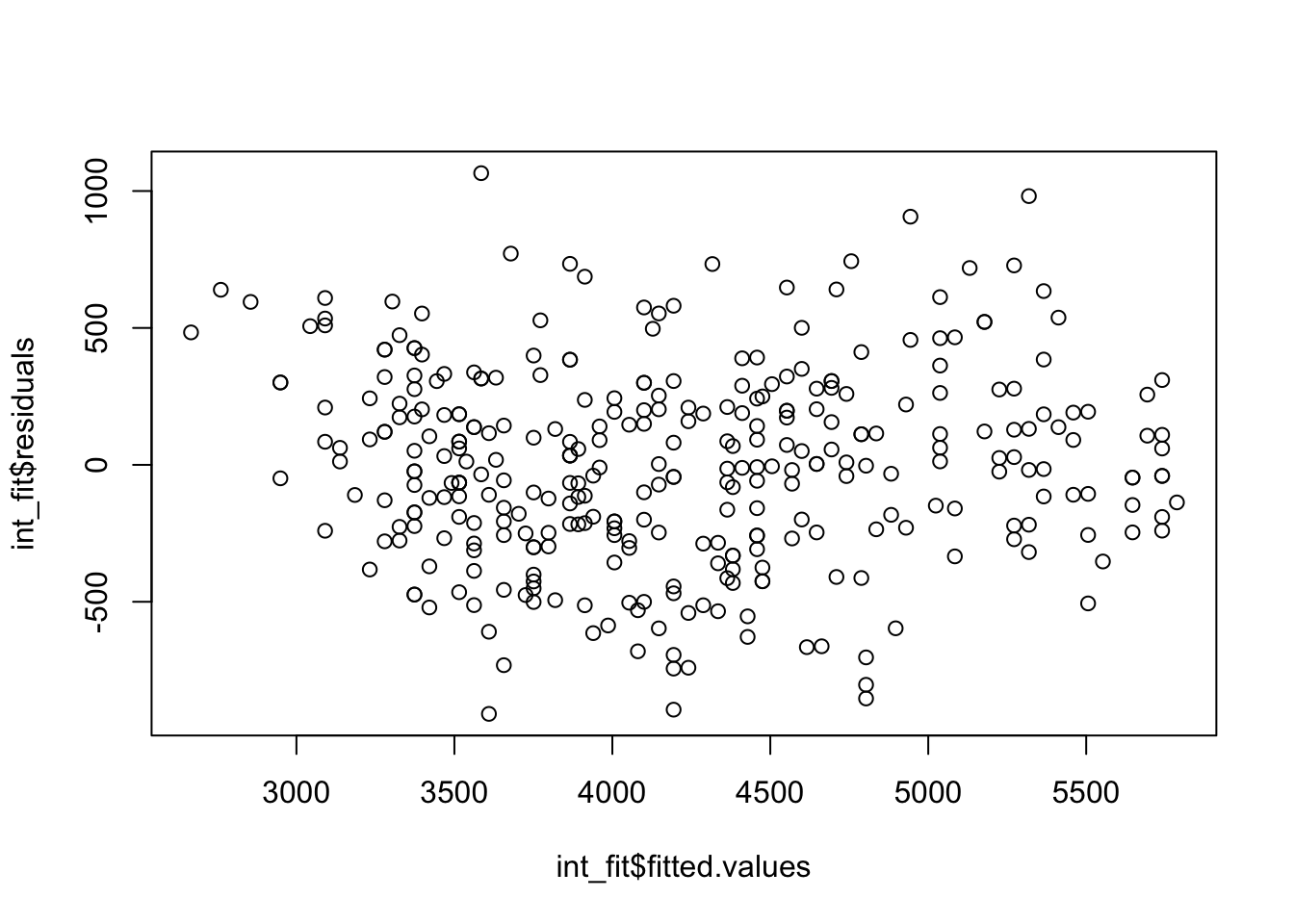

F-statistic: 11.17 on 3 and 328 DF, p-value: 5.323e-07Just as before we can check the residuals once we have saved the regression fit.

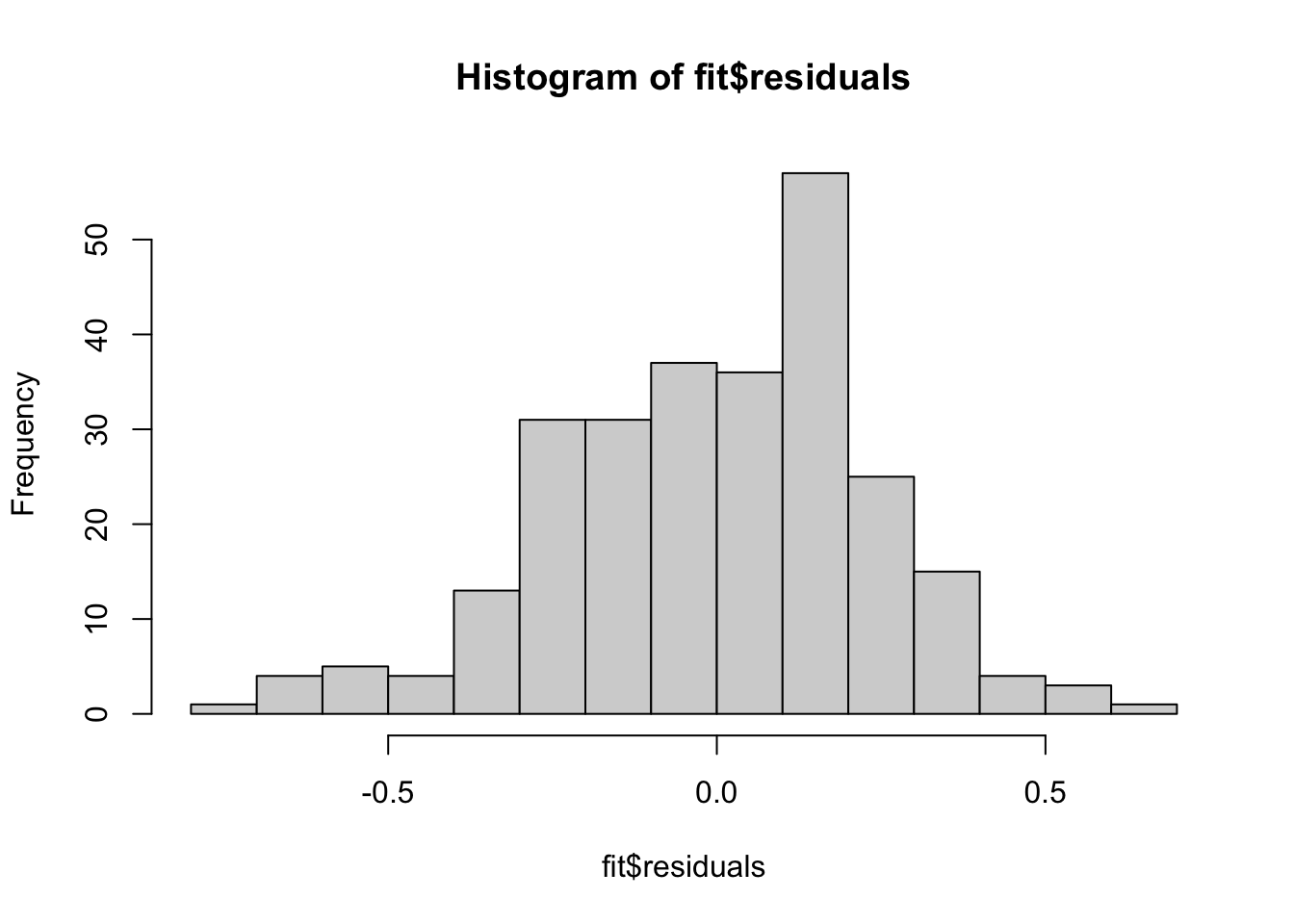

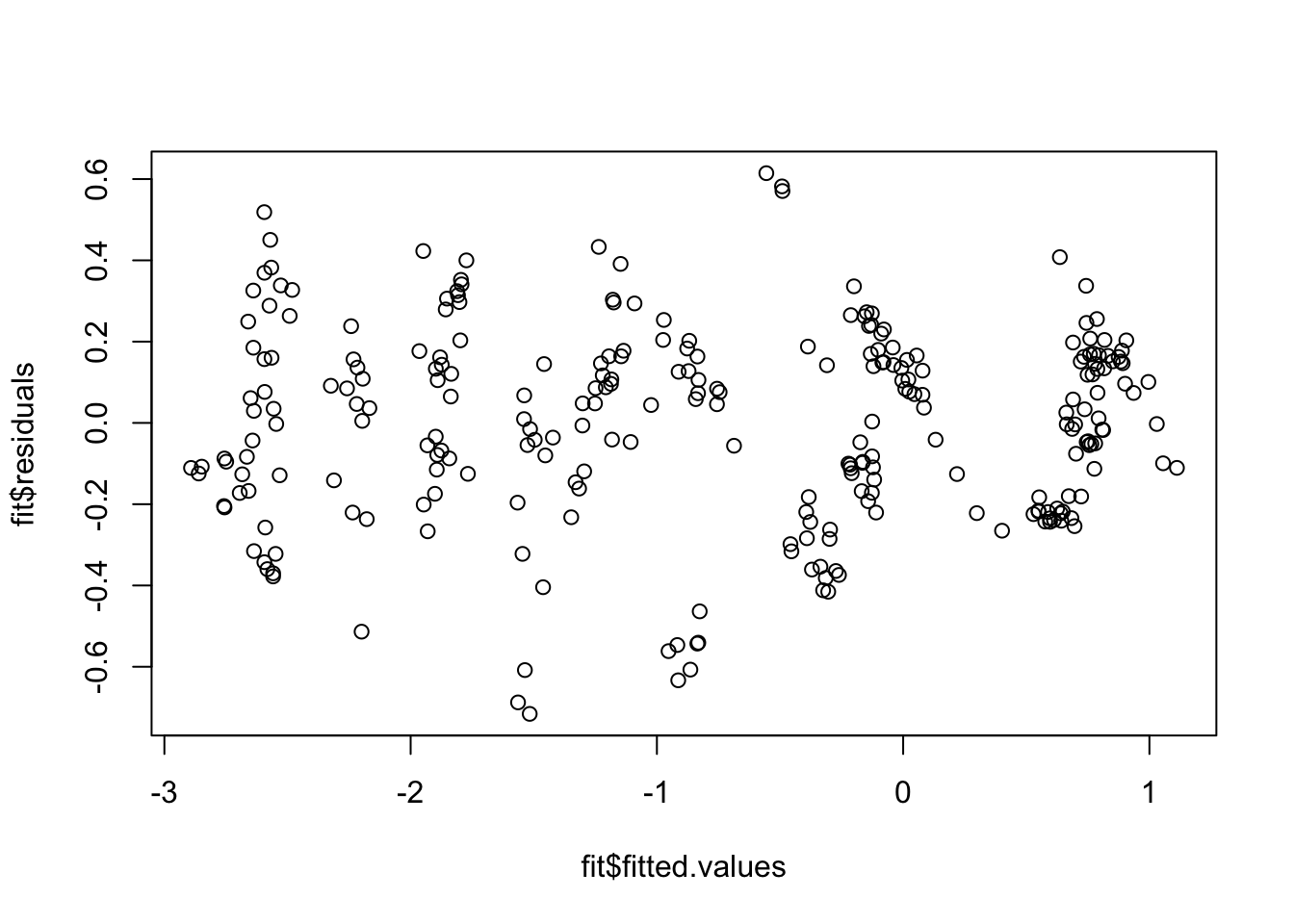

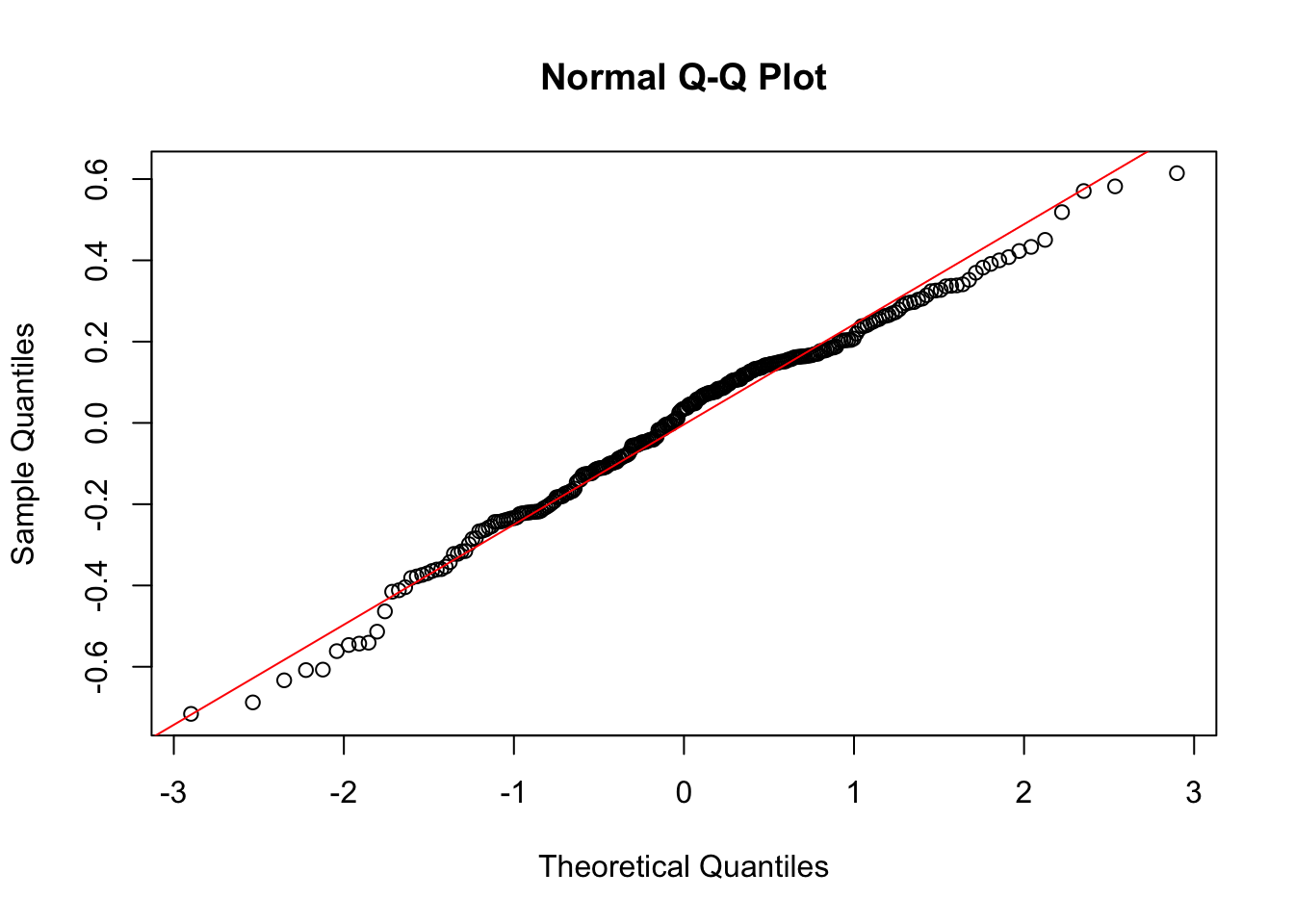

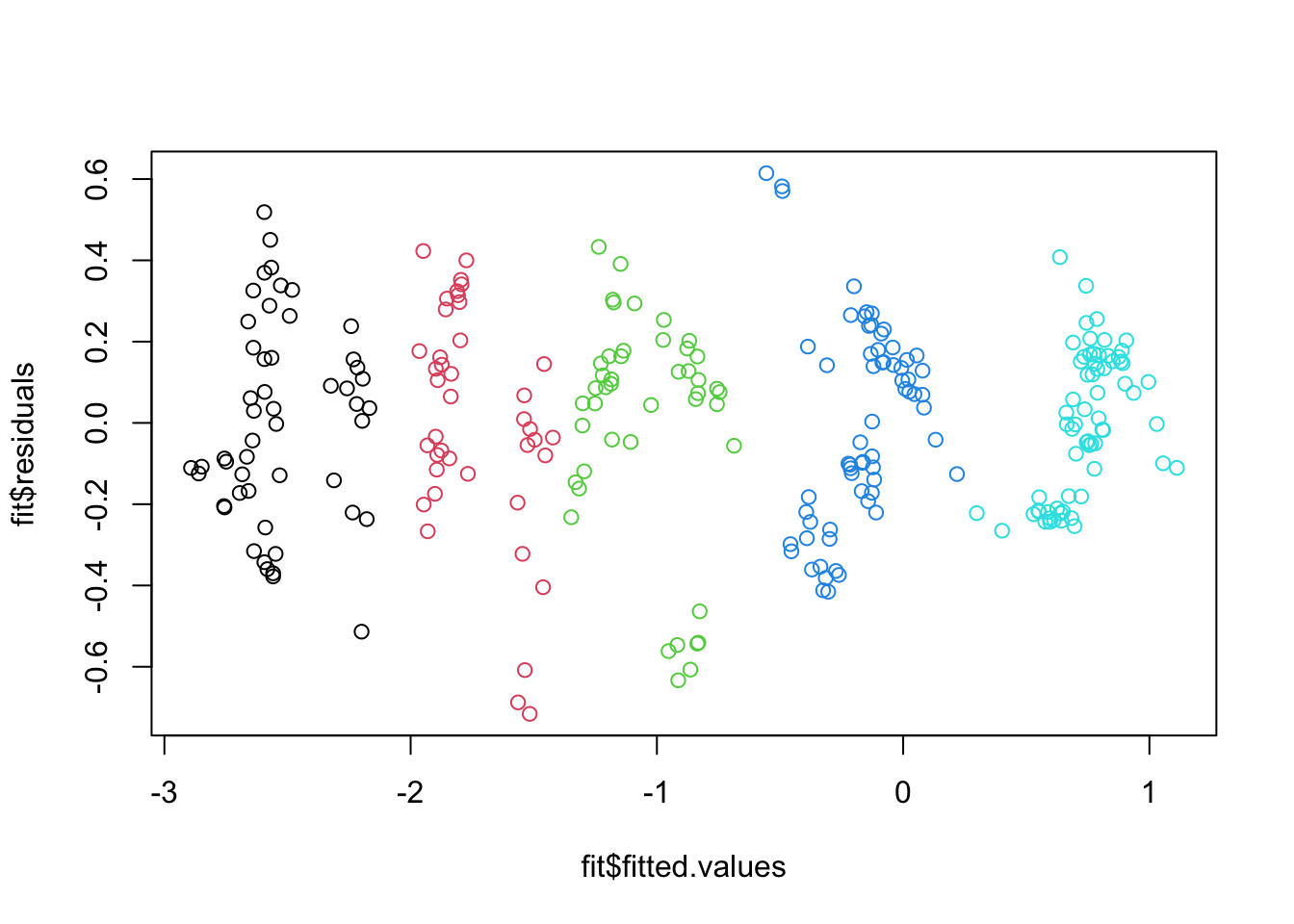

hist(glu_fit$residuals)

plot(x = glu_fit$fitted.values, y = glu_fit$residuals)

qqnorm(glu_fit$residuals)

qqline(glu_fit$residuals, col = "red")

Because these residual plots look quite good, we can then move on to interpreting the coefficients, doing hypothesis tests and constructing confidence intervals.

We also need to modify the definition of the residual standard error again, to account for the number of predictors in our model. The formula, which we saw before, is given by

\[ \hat{\sigma}_e = \sqrt{\frac{\sum_{i=1}^{n}(y_i - \hat{y}_i)^2}{n - p -1}}, \]

where we have \(p=3\) predictors here.

Interpreting the coefficients

How we interpret the coefficients is largely similar to what we did before, where we need to control for all other variables in our model. Looking at the output, we have \(\hat{\beta}_3=0.005\). This means that, under the fitted model, holding blood pressure and skin thickness fixed, a one unit increase in BMI leads to an average increase of the log glucose level of \(0.005\). Note that as was the case with only one predictor, we need to be a bit careful about the log transformation and the interpretation. These estimates only tell us about the relationship between \(\log Y\) and \(X\), not about \(Y\) and \(X\).

Testing the coefficients

We have seen that we can do two different types of tests for our coefficients:

An \(F\)-test, testing if all slope terms are zero

A regular \(t\)-test, for any one slope coefficient \(\beta_j\) while including all other predictors in the model

Recall that the \(F\)-test is used to test \(H_0:\beta_1=\beta_2 =\ldots =\beta_p =0\) vs \(H_A:\) at least one \(\beta_1,\beta_2,\ldots,\beta_p\neq 0\) at significance level \(\alpha\).

The test statistic \(f\) is

\[ f = \frac{MSModel}{MSError}, \]

which, under \(H_0\), follows an \(F\) distribution with \(p,n-p-1\) degrees of freedom. In this example we have \(p=3\) and the \(p\)-value, given by summary is less than \(\alpha =0.05\), so we would reject \(H_0\) at significance level \(\alpha\).

To test \(H_0:\beta_2=0\) vs \(H_A:\beta_2\neq 0\) at \(\alpha = 0.01\) for this example, we need the estimate, the standard error and the critical value of the corresponding \(t\)-distribution, which will have \(n-p-1\) degrees of freedom.

So in this example our test statistic will be

\[ t = \frac{0.0029-0}{0.00178} = 1.681 \]

and the critical value is \(t_{n-p-1=328, 0.005} = 2.59\), so because our test statistic is not further than 0 than the critical value, we fail to reject this \(H_0\).

Confidence and Prediction Intervals

We can also construct confidence and prediction intervals in this setting. These are very similar to what we saw before.

A \(100(1-\alpha)\%\) confidence interval for \(\beta_j\) will look like

\[ \left( \hat{\beta}_j - se(\hat{\beta}_j )t_{n-p-1,\alpha/2}, \hat{\beta}_j + se(\hat{\beta}_j )t_{n-p-1,\alpha/2} \right) \]

Note that if our model used \(\log(Y)\) instead of \(Y\), we cannot do a transformation to then say things about \(Y\) instead, using the confidence intervals for the coefficients.

We can also get confidence and prediction intervals for the response variable, \(Y\), even if we fit a model to some transformation of \(Y\). Again, these are quite similar to what we saw before, where again the standard errors will be too complex to show or calculate.

A \(100(1-\alpha)\%\) confidence interval for the average value of \(Y\), at values of the predictor variables \(x_1^{new},x_2^{new},\ldots,x_p^{new}\) will be

\[ \left( \hat{\beta}_0 +\hat{\beta}_1 x_1^{new}+\hat{\beta}_2 x_2^{new} + \ldots +\hat{\beta}_p x_p^{new}- t_{n-p-1,\alpha/2}S, \hat{\beta}_0 +\hat{\beta}_1 x_1^{new}+\hat{\beta}_2 x_2^{new} + \ldots + \hat{\beta}_p x_p^{new} + t_{n-p-1,\alpha/2}S \right). \]

Similarly, a \(100(1-\alpha)\%\) prediction interval will be

\[ \left( \hat{\beta}_0 +\hat{\beta}_1 x_1^{new}+\hat{\beta}_2 x_2^{new} + \ldots +\hat{\beta}_p x_p^{new}- t_{n-p-1,\alpha/2}S^*, \hat{\beta}_0 +\hat{\beta}_1 x_1^{new}+\hat{\beta}_2 x_2^{new} + \ldots + \hat{\beta}_p x_p^{new} + t_{n-p-1,\alpha/2}S^* \right), \]

where \(S^* > S\), as there is more uncertainty in predicting a new \(Y\) than the line at given values of \(x_1^{new},\ldots,x_p^{new}\).

For example, we can use the fitted model to predict the average log glucose level of someone with a bp of 80, a skin thickness measurement of 40 and a BMI of 25, or a prediction interval for a new person with those measurements.

new_data <- data.frame(bp = 80, skin = 40, bmi = 25)

predict(glu_fit, newdata = new_data, interval = c("confidence"),

level = 0.95) fit lwr upr

1 4.759401 4.679541 4.83926predict(glu_fit, newdata = new_data, interval = c("prediction"),

level = 0.95) fit lwr upr

1 4.759401 4.28649 5.232311For the intervals for \(Y\), we can transform these to get them on the original scale, by taking exp of the intervals.

exp(predict(glu_fit, newdata = new_data, interval = c("confidence"),

level = 0.95)) fit lwr upr

1 116.676 107.7206 126.3758exp(predict(glu_fit, newdata = new_data, interval = c("prediction"),

level = 0.95)) fit lwr upr

1 116.676 72.71078 187.225Challenges

As we add more variables to a regression model we run into more things that can go wrong. One of the most common issues that occurs in regressions like this is when you have predictors in your model which are highly correlated. Lets see a quick example with \(p=3\) predictors.

library(palmerpenguins)

multi_fit <- lm(body_mass_g ~ bill_length_mm +

bill_depth_mm + flipper_length_mm,

data = penguins)

summary(multi_fit)

Call:

lm(formula = body_mass_g ~ bill_length_mm + bill_depth_mm + flipper_length_mm,

data = penguins)

Residuals:

Min 1Q Median 3Q Max

-1054.94 -290.33 -21.91 239.04 1276.64

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -6424.765 561.469 -11.443 <2e-16 ***

bill_length_mm 4.162 5.329 0.781 0.435

bill_depth_mm 20.050 13.694 1.464 0.144

flipper_length_mm 50.269 2.477 20.293 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 393.4 on 338 degrees of freedom

(2 observations deleted due to missingness)

Multiple R-squared: 0.7615, Adjusted R-squared: 0.7594

F-statistic: 359.7 on 3 and 338 DF, p-value: < 2.2e-16Looking at this output, we get a large \(p\)-value for the coefficient related to bill_length, indicating it does not have a strong relationship with the weight of a penguin.

However, if we just run lm(body_mass_g ~ bill_length_mm, data = penguins), using only this predictor, this model says that the slope coefficient for bill_length_mm is statistically significant, and there is a strong linear relationship between them.

single_fit <- lm(body_mass_g ~ bill_length_mm, data = penguins)

summary(single_fit)

Call:

lm(formula = body_mass_g ~ bill_length_mm, data = penguins)

Residuals:

Min 1Q Median 3Q Max

-1762.08 -446.98 32.59 462.31 1636.86

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 362.307 283.345 1.279 0.202

bill_length_mm 87.415 6.402 13.654 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 645.4 on 340 degrees of freedom

(2 observations deleted due to missingness)

Multiple R-squared: 0.3542, Adjusted R-squared: 0.3523

F-statistic: 186.4 on 1 and 340 DF, p-value: < 2.2e-16How come these two models give different results? What about if we also consider the model with just flipper_length_mm as the predictor?

fit_2 <- lm(body_mass_g ~ flipper_length_mm, data = penguins)

summary(fit_2)

Call:

lm(formula = body_mass_g ~ flipper_length_mm, data = penguins)

Residuals:

Min 1Q Median 3Q Max

-1058.80 -259.27 -26.88 247.33 1288.69

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -5780.831 305.815 -18.90 <2e-16 ***

flipper_length_mm 49.686 1.518 32.72 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 394.3 on 340 degrees of freedom

(2 observations deleted due to missingness)

Multiple R-squared: 0.759, Adjusted R-squared: 0.7583

F-statistic: 1071 on 1 and 340 DF, p-value: < 2.2e-16Compare the previous results to the estimated slope coefficient and standard error for the flipper length. The estimate changes from one model to the next, but the standard error is much larger when all variables are included compared to the model with only flipper length as an \(x\) variable. This is even more apparent when we look at the estimates for the slope of bill_length in the previous two models.

We can also look at the \(R^2\) for multi_fit and for fit_2. They are almost identical, but fit_2 only has 1 predictor while multi_fit has 3. What is happening here? This happens because we are running a regression with predictors which are highly correlated, which makes it challenging to disentangle the relationship between \(Y\) and any single \(X\) variable. This also leads to standard errors for all coefficients, \(\hat{\beta}\), increasing when we add more variables. In even more extreme examples, a model with one \(x\) variable can have an estimated slope which is positive, while adding more variables can cause the estimate of the same relationship to become negative!

This will be more obvious if we use ggpairs on this data, which identifies that some of these variables are highly correlated.

ggpairs(penguins[, c("body_mass_g", "flipper_length_mm",

"bill_length_mm", "bill_depth_mm")])

The other predictors all have quite large positive or negative correlation with flipper_length_mm, which leads to difficulties. Because these other predictors are highly correlated with flipper_length_mm, they aren’t able to give us much more information. This is why we see we don’t get a much improved model (in terms of \(R^2\)) by adding them to the model. This can also lead to problems with even getting estimates of the coefficients, and their standard errors, and so it may be incorrect to do hypothesis tests or construct intervals if you have very highly correlated variables.

Variance Inflation Factor

One thing we can do to identify problems like this, apart from using ggpairs to see which variables are highly correlated, is to compute something called the Variance Inflation Factor, which can help identify highly correlated variables.

The variance inflation factor for the \(j\)-th variable in the model is given by

\[ VIF_j = \frac{1}{1 - R_j^2}, \]

where \(R_j^2\) is the \(R^2\) value you get if you fit a regression where \(X_j\) is your \(Y\) variable and you use all other predictors in the model.

We can compute this using the vif function in the car package. Here we do it using a dataset of different car models, where we are interested in understanding the relationship between the price of a car and several other variables. Note that if we have categorical variables (later), an extension will be needed, which is why the output is called GVIF. This will give the same answers for all the examples we will consider.

library(MASS)

library(car)

## use this dataset from the MASS package

car_data <- Cars93

fit <- lm(Price ~ MPG.city + MPG.highway + Cylinders + EngineSize + Horsepower + Passengers,

data = car_data)

summary(fit)

Call:

lm(formula = Price ~ MPG.city + MPG.highway + Cylinders + EngineSize +

Horsepower + Passengers, data = car_data)

Residuals:

Min 1Q Median 3Q Max

-15.509 -2.585 -0.754 1.721 31.993

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 17.10835 13.02500 1.314 0.193

MPG.city -0.31589 0.44268 -0.714 0.478

MPG.highway -0.04622 0.40308 -0.115 0.909

Cylinders4 -3.44972 4.63563 -0.744 0.459

Cylinders5 0.49253 6.91815 0.071 0.943

Cylinders6 -1.56899 5.74085 -0.273 0.785

Cylinders8 2.08057 7.17578 0.290 0.773

Cylindersrotary -8.01643 9.27716 -0.864 0.390

EngineSize -1.59851 1.68297 -0.950 0.345

Horsepower 0.12696 0.02506 5.067 2.45e-06 ***

Passengers -0.18214 0.88407 -0.206 0.837

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 6.112 on 82 degrees of freedom

Multiple R-squared: 0.6431, Adjusted R-squared: 0.5996

F-statistic: 14.78 on 10 and 82 DF, p-value: 1.209e-14vif(fit) GVIF Df GVIF^(1/(2*Df))

MPG.city 15.241506 1 3.904037

MPG.highway 11.374101 1 3.372551

Cylinders 14.399449 5 1.305673

EngineSize 7.506168 1 2.739739

Horsepower 4.240742 1 2.059306

Passengers 2.077728 1 1.441433We should be wary if we get large values of VIF

(the column called GVIF here) for any variables. One general heuristic is to try not have values of GVIF larger than 5, and definitely not larger than 10. For this example, if we remove some of the highly correlated variables, we will see these values decrease. This is probably not that surprising that when we have \(X\) variables for both the miles per gallon a car gets in a city and on the highway, they are highly correlated. We will also remove the number of cylinders.

cor(car_data$MPG.city, car_data$MPG.highway)[1] 0.9439358## removing mpg on highway and number of cylinders

fit <- lm(Price ~ MPG.city + EngineSize + Horsepower + Passengers,

data = car_data)

summary(fit)

Call:

lm(formula = Price ~ MPG.city + EngineSize + Horsepower + Passengers,

data = car_data)

Residuals:

Min 1Q Median 3Q Max

-15.250 -2.778 -1.142 1.860 32.060

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 4.95494 8.73593 0.567 0.572

MPG.city -0.20349 0.18468 -1.102 0.274

EngineSize -0.17242 1.07196 -0.161 0.873

Horsepower 0.13317 0.02192 6.075 3.08e-08 ***

Passengers 0.08108 0.79059 0.103 0.919

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 6.016 on 88 degrees of freedom

Multiple R-squared: 0.629, Adjusted R-squared: 0.6121

F-statistic: 37.29 on 4 and 88 DF, p-value: < 2.2e-16vif(fit) MPG.city EngineSize Horsepower Passengers

2.738067 3.143335 3.350173 1.715094 Note that although we have removed 2 predictors, our \(R^2\) is almost the exact same value. Also, the standard errors look completely different. This is due to the high correlations that were present when we included the other predictors.

R-Squared

You might have noticed in the previous section that we often saw adding more predictor variables leads to only a small increase in the value of \(R^2\). It turns out, adding new predictors will always lead to an increase in \(R^2\), even if they are not appropriate. If we just add random data to our model, which is completely independent of \(Y\), it will still lead to a (small) increase in \(R^2\).

fit <- lm(Price ~ MPG.city + EngineSize + Horsepower + Passengers,

data = car_data)

summary(fit)

Call:

lm(formula = Price ~ MPG.city + EngineSize + Horsepower + Passengers,

data = car_data)

Residuals:

Min 1Q Median 3Q Max

-15.250 -2.778 -1.142 1.860 32.060

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 4.95494 8.73593 0.567 0.572

MPG.city -0.20349 0.18468 -1.102 0.274

EngineSize -0.17242 1.07196 -0.161 0.873

Horsepower 0.13317 0.02192 6.075 3.08e-08 ***

Passengers 0.08108 0.79059 0.103 0.919

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 6.016 on 88 degrees of freedom

Multiple R-squared: 0.629, Adjusted R-squared: 0.6121

F-statistic: 37.29 on 4 and 88 DF, p-value: < 2.2e-16## add random noise

noise <- rnorm(n = nrow(car_data))

car_data$noise <- noise

new_fit <- lm(Price ~ MPG.city + EngineSize + Horsepower + Passengers +

noise,

data = car_data)

summary(new_fit)

Call:

lm(formula = Price ~ MPG.city + EngineSize + Horsepower + Passengers +

noise, data = car_data)

Residuals:

Min 1Q Median 3Q Max

-15.6660 -2.9221 -0.9139 2.0742 30.8479

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 6.13886 8.74791 0.702 0.485

MPG.city -0.21988 0.18436 -1.193 0.236

EngineSize -0.11744 1.06849 -0.110 0.913

Horsepower 0.13287 0.02183 6.086 3.04e-08 ***

Passengers -0.10399 0.80004 -0.130 0.897

noise 0.83579 0.63922 1.308 0.194

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 5.992 on 87 degrees of freedom

Multiple R-squared: 0.6361, Adjusted R-squared: 0.6152

F-statistic: 30.42 on 5 and 87 DF, p-value: < 2.2e-16Note that the computed \(R^2\) actually goes slightly up. When we have multiple \(X\) variables then \(R^2\) depends on the correlation between \(Y\) and \(\hat{Y}\), rather than between \(X\) and \(Y\). When we add a new variable, it can often lead to an increase in this correlation, even when the variable doesn’t have any true relationship with the \(Y\) variable of interest.

This is where the adjusted R squared, which is also given in the output of summary, finally comes into use. You’ll notice in this example, when we add the new \(x\) which is just random, the adjusted \(R^2\) actually decreases. This happened for the previous model with the additional variable also. It turns out that this other \(R^2\) can be used to give us information about whether to include a new predictor in our model.

Adjusted R-Squared

The adjusted R squared has a different definition to what we saw before.

Remember that

\[ R^2 = \frac{SSTotal - SSError}{SSTotal} = 1 - \frac{SSError}{SSTotal}. \]

This adjusted \(R^2\) accounts for the number of predictors \(p\) and the number of data points in our model, \(n\).

\[ R_{adj}^2 = 1-\frac{\frac{SSError}{n-p-1}}{\frac{SSTotal}{n-1}}. \]

If we remember the definition for \(\hat{\sigma}_{e}\), we can recognize that

\[ \hat{\sigma}_e^2 = \frac{SSError}{n-p-1} = \frac{\sum_{i}(y_i - \hat{y}_i)^2}{n-p-1}. \]

For the denominator, note that we previously said the sample variance of a sample given was by

\[ s_y^2 = \frac{1}{n}\sum_{i=1}^{n}(y_i -\bar{y})^2. \]

For technical (and most of the time not important) reasons 1, people often define this using \(n-1\) on the denominator,

\[ s_y^2 = \frac{1}{n-1}\sum_{i=1}^{n}(y_i -\bar{y})^2. \]

If we use this definition instead, then we can write this adjusted \(R^2\) as

\[ R_{adj}^2 = 1 - \frac{\hat{\sigma}_e^2}{s_y^2}. \] With this new definition of \(R_{adj}^2\), adding a new predictor which does not reduce the variability of the residuals by enough to account for the increase in \(p\) will lead to a smaller value of \(R_{adj}^2\).

3.5 Numeric and Binary Variables

The regression examples we have seen in this class so far has consisted of all variables being continuous. In practice, if you collect data you may have other types of variables, such as binary or categorical variables. For the penguin data, if we are interested in the weight of penguins, it probably makes sense to use the species of penguin in this model. We would like to include these variables in our regression model also. There are essentially two ways of doing this. We can:

Have a different intercept term for each group

Have a different slope term for each group

These two types of models will have different interpretations. Lets start with a simple example where we have a binary variable, the sex of penguins, which can be either male or female. We want to understand the relationship between their weight (\(Y\)) and their flipper length (\(X\)) while accounting for sex. We can see this with a plot, where we colour the points differently for male and female penguins.

We include sex as a predictor in our model, which we will call \(X_2\). \(X_1\) is the flipper length. Then, we can write a regression model as

\[ Y = \beta_0 + \beta_1 X_1 + \beta_2 X_2 + \epsilon. \]

When fitting this model in R, \(X_2\) can either be male or female. The way to handle this is to set \(X_2=0\) for one of these categories and \(X_2=1\) for the other. R does this alphabetically by default, so for a female penguin we will have \(X_2=0\) and for a male penguin \(X_2 = 1\). Lets think about how this model will change for the possible values of \(X_2\). When \(X_2=0\) then we will have

\[ Y =\beta_0 +\beta_1 X_1 +\epsilon\ \ \mathrm{(female)}, \]

while when \(X_2=1\) we will have

\[ Y = (\beta_0 + \beta_2) + \beta_1 X_1 +\epsilon \ \ \mathrm{(male)}. \]

We can call \(X_2\) an indicator variable, because its value indicates which group that observation is in. Essentially, we have a different intercept term for each group, but the same slope. This will result in two regression lines, one for each group, with the same slopes but different intercepts. This is shown in the next figure.

So we are basically fitting a separate line to each of the two groups, with the condition that they have to have the same slope.

Before we think about interpreting this model, we will see how to fit it and, like always, how to check the conditions for a regression model are satisfied.

bin_fit <- lm(body_mass_g ~ flipper_length_mm + sex,

data = penguins)

summary(bin_fit)

Call:

lm(formula = body_mass_g ~ flipper_length_mm + sex, data = penguins)

Residuals:

Min 1Q Median 3Q Max

-910.28 -243.89 -2.94 238.85 1067.73

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -5410.300 285.798 -18.931 < 2e-16 ***

flipper_length_mm 46.982 1.441 32.598 < 2e-16 ***

sexmale 347.850 40.342 8.623 2.78e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 355.9 on 330 degrees of freedom

(11 observations deleted due to missingness)

Multiple R-squared: 0.8058, Adjusted R-squared: 0.8047

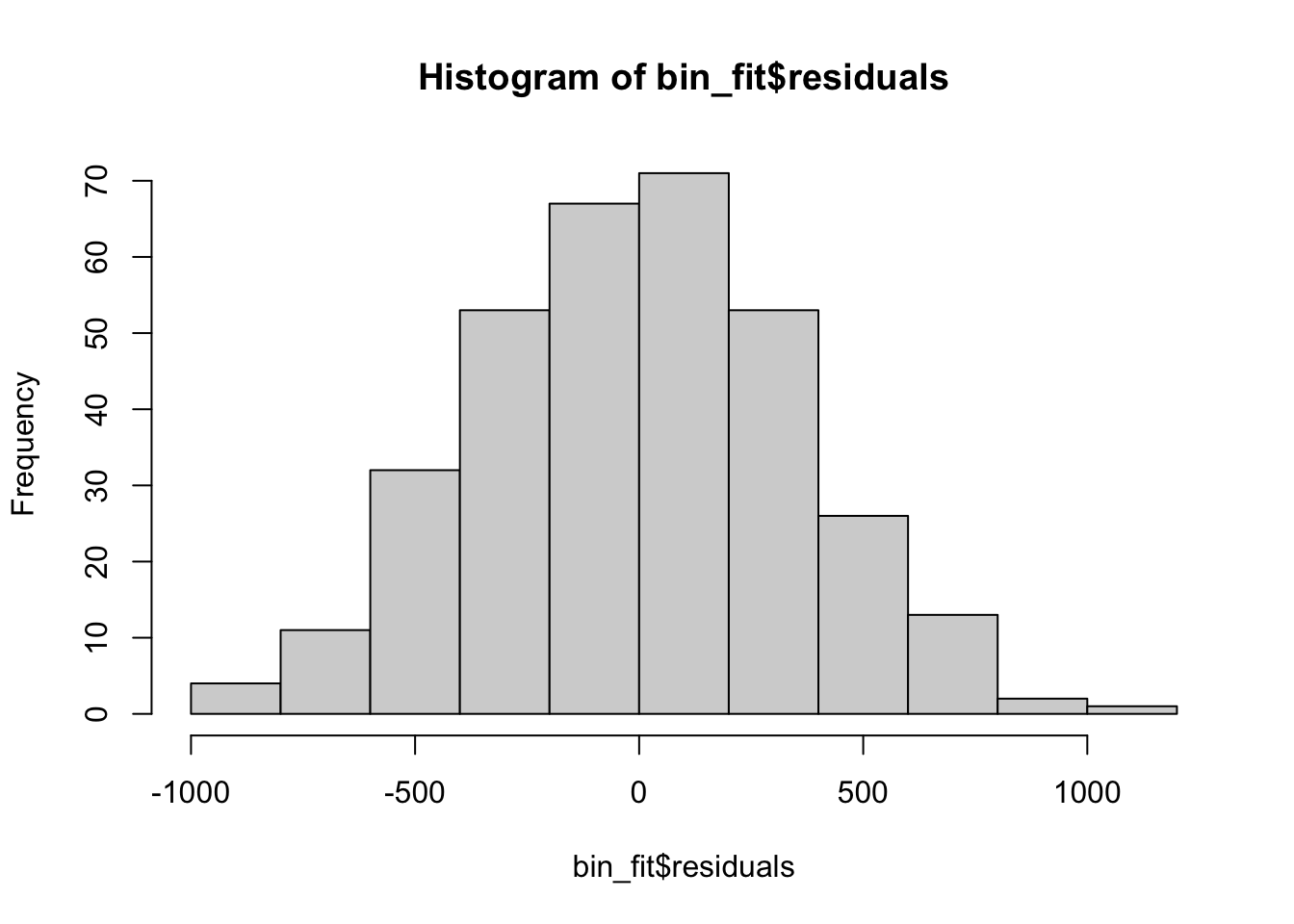

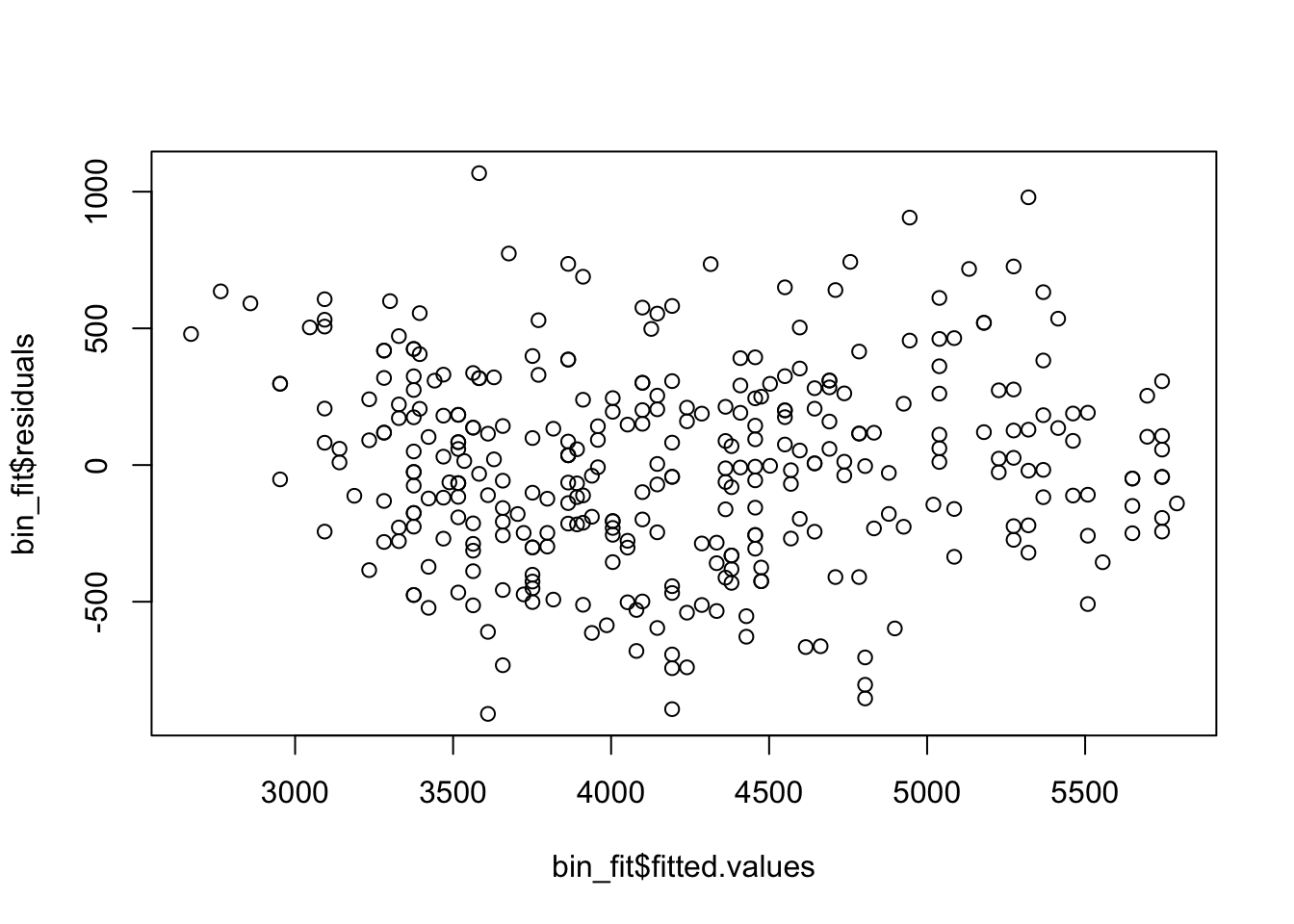

F-statistic: 684.8 on 2 and 330 DF, p-value: < 2.2e-16Checking the residuals is identical to before, because we are still just using lm.

hist(bin_fit$residuals)

plot(x = bin_fit$fitted.values, y = bin_fit$residuals)

qqnorm(bin_fit$residuals)

qqline(bin_fit$residuals, col = "red")

Here the residuals look very reasonable and we have no concerns about our regression model being valid. This means we can interpret the coefficients.

Now, the only thing which is different to what we saw before is how to interpret the intercept terms, \(\hat{\beta}_2\) and \(\hat{\beta}_0\). \(\hat{\beta}_0\) gives us the average weight for a female penguin with flipper length of 0. \(\hat{\beta}_2\) tells us about how the intercept changes from female to male penguins. What this says now is that if we have two penguins with the same flipper length, one male and one female, a male penguin will, on average, weigh \(\hat{\beta}_2\) grams more. Similarly, we can get a confidence interval for \(\beta_2\) using all the output we have above. This regression model allows us to describe the relationship between flipper length and body mass in the two groups of data at once.

We can also test \(H_0:\beta_2=0\) vs \(H_A:\beta_2\neq 0\) at \(\alpha=0.01\). We can get the critical value from a \(t\)-distribution with \(n-p-1\) degrees of freedom, where \(p=2\) here. Or, we can just look straight at the \(p\)-value in the output. Because this is smaller than \(\alpha\), we reject \(H_0\). Testing \(\beta_2\) means we are testing whether we need a different intercept for male and female penguins, or if we can describe the relationship between flipper length and body mass using just a single line for both male and female penguins.

Interactions

The previous model allowed us to have a different intercept for each of the two groups, which seemed to give a sensible model. However, what if we wanted to allow the slopes to vary across groups also?

To fit this model, we will write our regression in the following way, where we have the same variables as before,

\[ Y = \beta_0 +\beta_1 X_1 + \beta_2 X_2 + \beta_3 X_1 X_2 +\epsilon. \]

We call \(\beta_3 X_1 X_2\) an interaction term, describing the interaction between \(X_1\) and \(X_2\). Again, we will look at what happens when \(X_2=0\) and \(X_2=1\).

When \(X_2=0\) then we will have

\[ Y =\beta_0 +\beta_1 X_1 +\epsilon\ \ \mathrm{(female)}, \]

while when \(X_2=1\) we will have

\[ Y = (\beta_0 + \beta_2) + (\beta_1+\beta_3) X_1 +\epsilon \ \ \mathrm{(male)}. \]

So we will have a different slope and intercept for each of the two groups.

We can also fit this model using lm, where to include an interaction term we can write this as the product of the two \(x\) variables.

int_fit <- lm(body_mass_g ~ flipper_length_mm + sex + sex*flipper_length_mm,

data = penguins)

summary(int_fit)

Call:

lm(formula = body_mass_g ~ flipper_length_mm + sex + sex * flipper_length_mm,

data = penguins)

Residuals:

Min 1Q Median 3Q Max

-909.36 -246.58 -3.13 237.18 1065.19

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -5443.9607 440.2829 -12.365 <2e-16 ***

flipper_length_mm 47.1527 2.2264 21.179 <2e-16 ***

sexmale 406.8015 587.3029 0.693 0.489

flipper_length_mm:sexmale -0.2942 2.9242 -0.101 0.920

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 356.4 on 329 degrees of freedom

(11 observations deleted due to missingness)

Multiple R-squared: 0.8058, Adjusted R-squared: 0.8041

F-statistic: 455.2 on 3 and 329 DF, p-value: < 2.2e-16Again, we need to check the linear regression assumptions look to be satisfied before we can interpret this model and the estimates it gives.

hist(int_fit$residuals)

plot(x = int_fit$fitted.values, y = int_fit$residuals)

qqnorm(int_fit$residuals)

qqline(int_fit$residuals, col = "red")

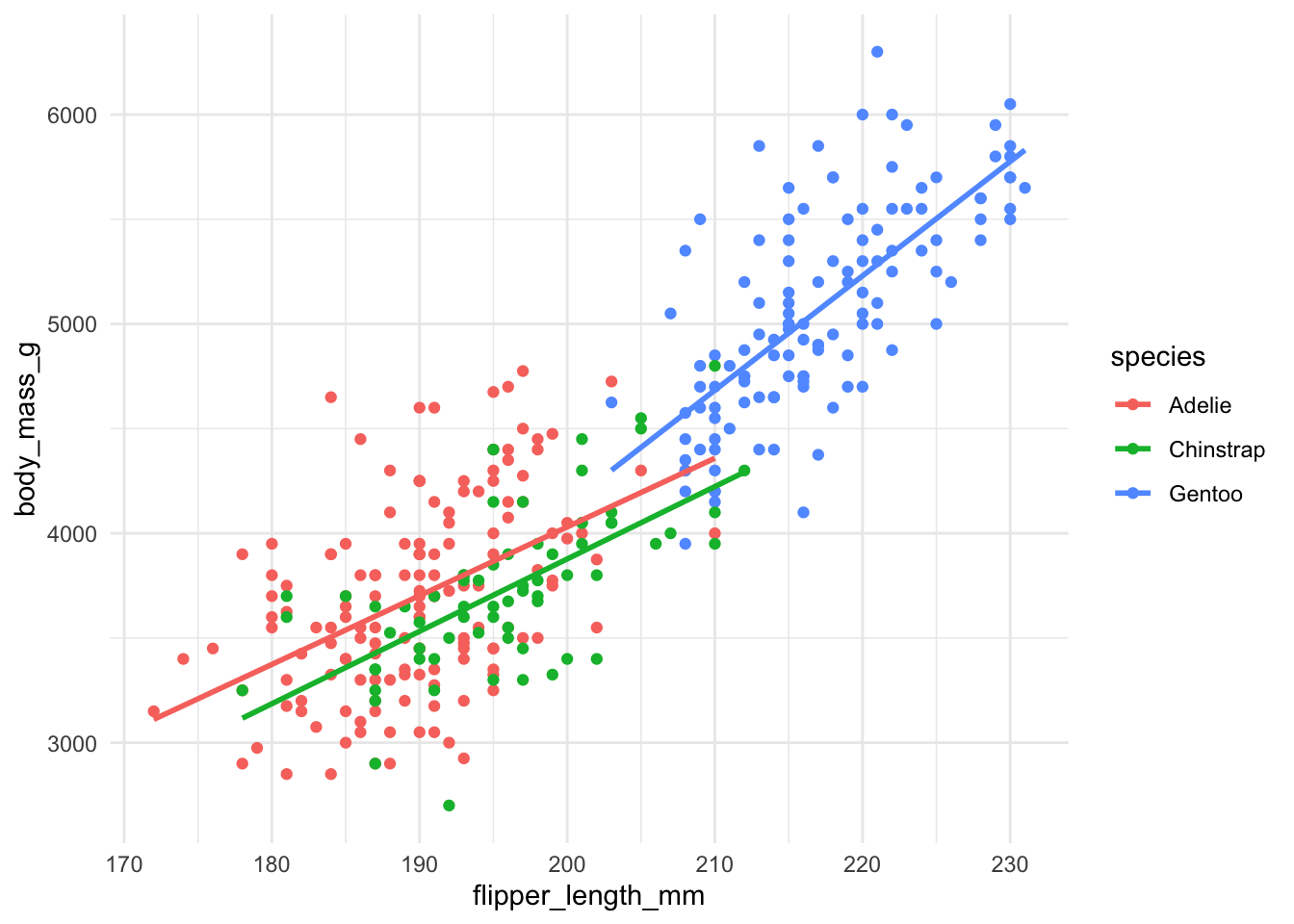

Now we are saying there is an interaction between flipper length and sex, and the influence that flipper length has on the \(Y\) variable depends on the sex variable.

Comparing the slopes

Now an interesting question is whether we need a different slope for the two groups. From the plot, it seems like the slopes of these models are very similar, and we can examine this exactly by constructing confidence intervals or hypothesis tests for the value of \(\beta_3\), which is given by the last row of the summary output. Note that we have \(p=3\) slope coefficients \(\beta_1,\beta_2,\beta_3\), so the critical value will be from a t-distribution with \(n-p-1\) degrees of freedom.

For example, if we did a hypothesis test for \(H_0:\beta_3=0\) vs \(H_A:\beta_3\neq 0\) at \(\alpha=0.1\), we can see that the given \(p\)-value is 0.92, so we would fail to reject \(H_0\) at this significance level \(\alpha\). This means we have no evidence that there is a different slope for the two different groups.

We tested if \(\beta_2=0\) for the first model (different intercepts) and \(\beta_3=0\) for the second model (different slope and different intercept). We cannot do both these two tests for the same model to see if there is any relationship between the model and sex, because we would be doing multiple tests on the same data, which is a problem known as multiple testing. This means that the p-values given in summary are not correct if we use more than one of them. In a later section, we will see another method where we can use ANOVA techniques to investigate this.

3.6 Numeric and Categorical Variables

In the previous section we saw how to incorporate a binary variable into a regression model. What about a more general categorical variable, which can take more than 2 values? For the penguin data, the species variable is natural to include, and there are three species of penguin in this data. It makes sense to imagine that different species of penguins have different characteristics and incorporating them in a model would better describe this relationship.

It is slightly more complicated to include categorical variables in a regression model. Lets first consider a different slope for each of the 3 species. Lets first see the regression model in R and then we will describe the actual model that results in this code.

cat_fit <- lm(body_mass_g ~ flipper_length_mm + species,

data = penguins)

summary(cat_fit)

Call:

lm(formula = body_mass_g ~ flipper_length_mm + species, data = penguins)

Residuals:

Min 1Q Median 3Q Max

-927.70 -254.82 -23.92 241.16 1191.68

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -4031.477 584.151 -6.901 2.55e-11 ***

flipper_length_mm 40.705 3.071 13.255 < 2e-16 ***

speciesChinstrap -206.510 57.731 -3.577 0.000398 ***

speciesGentoo 266.810 95.264 2.801 0.005392 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 375.5 on 338 degrees of freedom

(2 observations deleted due to missingness)

Multiple R-squared: 0.7826, Adjusted R-squared: 0.7807

F-statistic: 405.7 on 3 and 338 DF, p-value: < 2.2e-16We have 3 species in this dataset but you’ll have noticed that we only get coefficients for two of the 3 species. This is because of the use of indicator variables.

We will create a variable \(X_2\) which is 1 if the penguin is Chinstrap, and 0 otherwise. Similarly, we will have \(X_3\), which is 1 is the penguin is Gentoo and 0 otherwise. So then the model is

\[ Y =\beta_0 + \beta_1 X_1 + \beta_2 X_2 + \beta_3 X_3 +\epsilon. \]

Lets consider what will happen for each of the three species. When the penguin is Adelie, then \(x_2=x_3=0\) and the model is

\[ Y = \beta_0 +\beta_1 x_1+\epsilon\ \ \textrm{(Adelie)}. \]

So for this group we will have intercept \(\beta_0\). When the penguin in Chinstrap then we have \(x_2=1\) and \(x_3=0\) giving

\[ Y = \beta_0 + \beta_2 +\beta_1 x_1+\epsilon\ \ \textrm{(Chinstrap)}. \]

For this group we will have intercept \(\beta_0 + \beta_2\). Finally, when we have a Gentoo penguin then \(x_2=0\) and \(x_3=1\) giving

\[ Y = \beta_0 +\beta_3 +\beta_1 x_1+\epsilon\ \ \textrm{(Gentoo)}. \]

For this group we will have intercept \(\beta_0 + \beta_3\). We will have the same slope \(\beta_1\) throughout. If our categorical variable has \(k\) categories then we need to include \(k-1\) variables to have all the categories in the model. We have a categorical variable for every category except the first, which is the baseline model. Then \(\beta_2\) and \(\beta_3\) tell us how much the other categories differ from that baseline. Again, this is done by default in alphabetical order.

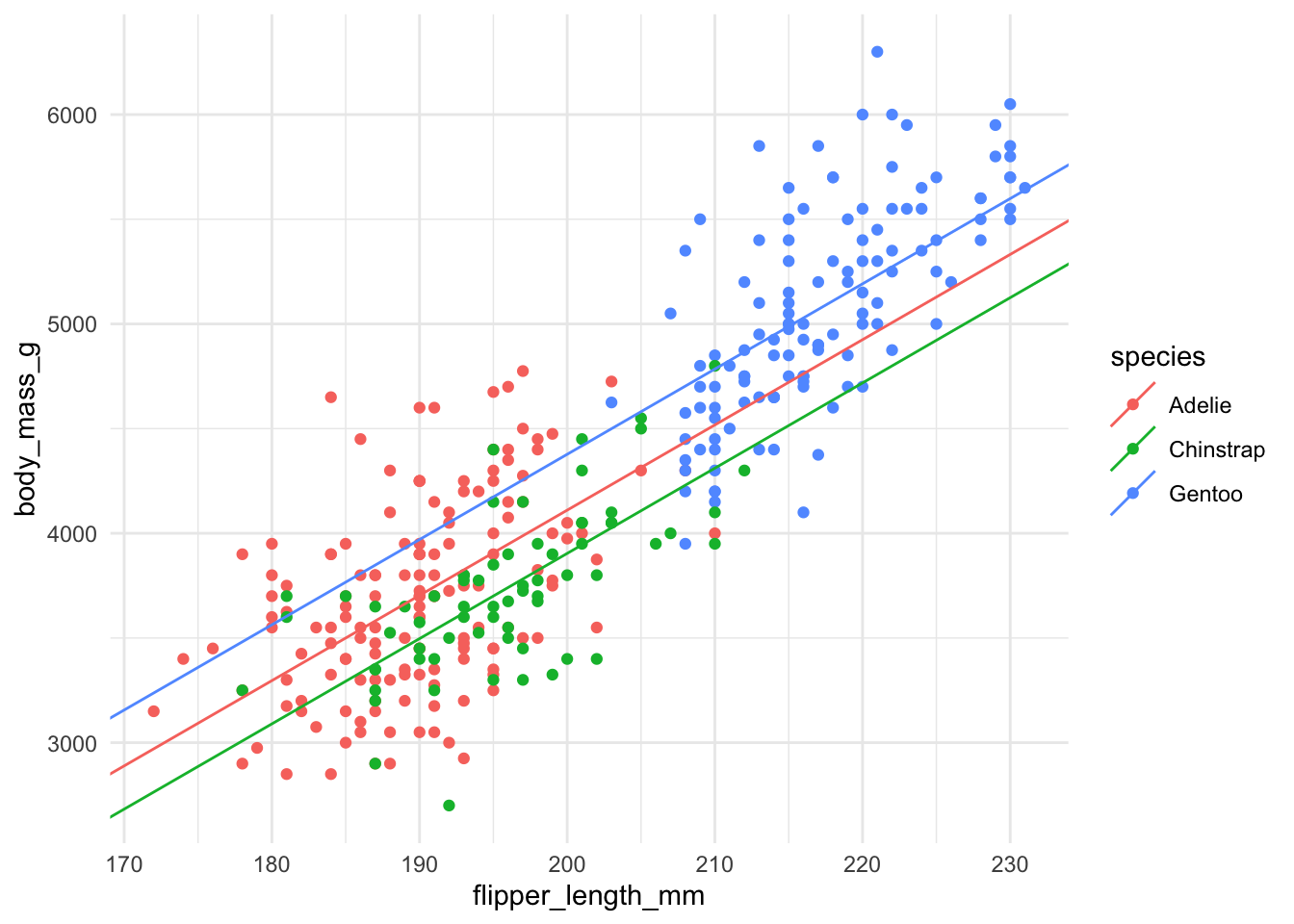

We can see what the resulting model looks like, where we have the same slope but different intercepts for each species.

Once we check the residuals satisfy the required assumptions then we can again do hypothesis tests and confidence intervals and interpret these coefficients.

For example, \(\hat{\beta}_2\) now tells us how the intercept changes, on average, for Chinstrap penguins compared to Adelie penguins. All these interpretations are with respect to the first category, the baseline.

Just as before, we could also allow the intercept and the slope to vary for each of the categories. Again, this makes interpretation slightly more complicated, but all the ideas that we have seen now follow as before. The resulting regression lines are shown below.

The regression formula for this model is then

\[ Y = \beta_0 + \beta_1 X_1 +\beta_2 X_2 +\beta_3 X_3 +\beta_4 X_1 X_2 + \beta_5 X_1 X_3 + \epsilon, \]

where we need an interaction between \(X_1\) and each of the categorical indicators. As before, we could consider testing whether we need a different intercept and/or slope for each of the groups, but these tests will require further ANOVA techniques which we will cover later in the semester. We will not discuss this model further, but by now you might be thinking that we could consider a lot of different models and its not clear how complicated we should go. The next section will provide some answers to these questions.

3.7 Model Complexity and Model Selection

We have now seen how we can go from a very simple regression model for \(Y\), with a single predictor \(X\), and extend this in numerous ways, incorporating many different types of variables and also functions of these variables. We now need to start thinking about how we actually decide on a model to use. Should we include \(X_1\) and \(X_2\) in our model? What about \(X_4\) or \(X_1^2\)?

While we only saw interactions previously between numeric and binary or categorical variables, we can actually have them between any types of variables we can put in our model. In theory, if you have 6 different predictors, you could have 15 potential interaction between any two of those variables! Very quickly, there are just too many different models to consider. Similarly, as we saw when looking at polynomial regression, it is easy to overfit a model to data if you include too many possible predictors.

We have seen already that we need a measure to quantify how “good” a model is, when we add additional variables, and that the regular \(R^2\) is no longer sufficient once we have more than one predictor. The adjusted R-squared improves over this, but we will see that there are other metrics we could consider also. We will see that we can actually use these methods to decide whether to include a variable as a predictor in our model or not. Or, if we have a model, we can use them to potentially remove an unnecessary predictor from our model.

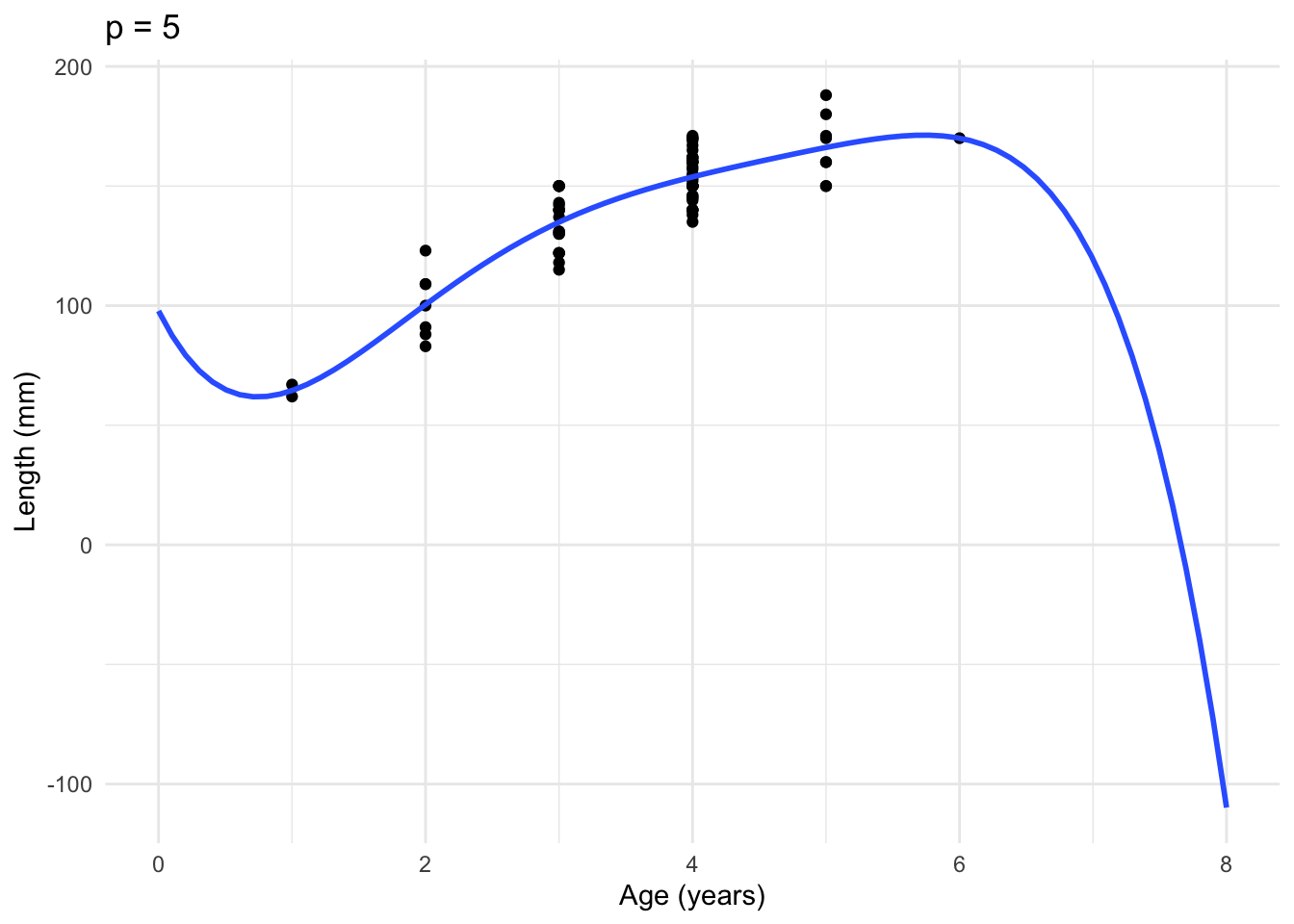

One way to see the problems of overfitting again is to look how a prediction interval can change as we make our model more complicated. Our prediction interval can actually get larger. This is most obvious when we try to predict at the edges of the observed data. We saw the fish data previously where we wanted to explore the relationship between the age of a fish (all 6 years or younger) and their length. We can compute a prediction interval for a 7 year old fish.

fit_quad <- lm(length ~ age + I(age^2), data = fish_data)

new_data <- data.frame(age = 7)

predict(fit_quad, new_data, interval = "prediction", level = 0.95) fit lwr upr

1 160.753 127.664 193.8419## fit a polynomial of order 5, more flexible but possibly overfits

fit_comp <- lm(length ~ poly(age, 5), data = fish_data)

predict(fit_comp, new_data, interval = "prediction", level = 0.95) fit lwr upr

1 119.3607 -92.5985 331.32Here, we compare a quadratic model to a polynomial of order 5. The prediction interval for the \(p=5\) polynomial is useless. The estimated value is not even in the interval from the quadratic model. This is even more obvious when we plot the fitted regressions.

Similarly, while we quite easily interpret the relationships if we have one or two predictors in our model, as we add more predictors, and interactions between these predictors, it quickly becomes difficult to understand the model we are fitting. If we want to try use our regression to understand some scientific process, it would probably help if we can understand it. Then we might be able to explain what the coefficients mean, at least somewhat. Similarly, we probably don’t think all possible variables are actually “important”. It can be hard to interpret what variables are important when a model gets particularly complicated.

Example

Lets see an example of a particularly complicated model that is difficult to understand. Here we will use a dataset of house prices in Iowa. We have nearly 24 thousand houses and information for different 82 variables, which are numeric and categorical. We can include all these variables as predictors for the price of a house. This can be done in R using the notation lm(Y ~ .), where . indicates every other column in the data.

Because there are many categorical variables, this gives a model with \(p=270\) predictors! Looking at even just a small piece of this output, you would agree that it is difficult to interpret.

library(modeldata)

## the data is contained in this package

big_fit <- lm(Sale_Price ~ ., data = ames)

summ <- summary(big_fit)

summ$coefficients[1:20, ] Estimate Std. Error

(Intercept) -2.083608e+07 10158540.656

MS_SubClassOne_Story_1945_and_Older 8.334772e+03 3272.755

MS_SubClassOne_Story_with_Finished_Attic_All_Ages 1.996254e+04 11128.340

MS_SubClassOne_and_Half_Story_Unfinished_All_Ages 1.283541e+04 13007.779

MS_SubClassOne_and_Half_Story_Finished_All_Ages 8.222432e+03 5996.520

MS_SubClassTwo_Story_1946_and_Newer -2.042516e+03 5174.432

MS_SubClassTwo_Story_1945_and_Older 1.345448e+04 5699.297

MS_SubClassTwo_and_Half_Story_All_Ages -4.881135e+03 9803.052

MS_SubClassSplit_or_Multilevel -9.261506e+03 10063.724

MS_SubClassSplit_Foyer -3.006487e+03 7029.075

MS_SubClassDuplex_All_Styles_and_Ages -2.169730e+04 5264.905

MS_SubClassOne_Story_PUD_1946_and_Newer -3.330004e+04 9650.056

MS_SubClassOne_and_Half_Story_PUD_All_Ages -3.584312e+04 27956.906

MS_SubClassTwo_Story_PUD_1946_and_Newer -3.653626e+04 11343.108

MS_SubClassPUD_Multilevel_Split_Level_Foyer -3.739830e+04 13291.602

MS_SubClassTwo_Family_conversion_All_Styles_and_Ages -7.677117e+03 16433.878

MS_ZoningResidential_High_Density 1.123161e+03 7011.875

MS_ZoningResidential_Low_Density 2.947611e+02 4686.779

MS_ZoningResidential_Medium_Density -3.503810e+03 5343.390

MS_ZoningA_agr -1.425126e+04 33705.666

t value Pr(>|t|)

(Intercept) -2.05108976 4.035600e-02

MS_SubClassOne_Story_1945_and_Older 2.54671395 1.093016e-02

MS_SubClassOne_Story_with_Finished_Attic_All_Ages 1.79384682 7.295120e-02

MS_SubClassOne_and_Half_Story_Unfinished_All_Ages 0.98674860 3.238557e-01

MS_SubClassOne_and_Half_Story_Finished_All_Ages 1.37120048 1.704282e-01

MS_SubClassTwo_Story_1946_and_Newer -0.39473247 6.930720e-01

MS_SubClassTwo_Story_1945_and_Older 2.36072582 1.831100e-02

MS_SubClassTwo_and_Half_Story_All_Ages -0.49791995 6.185816e-01

MS_SubClassSplit_or_Multilevel -0.92028620 3.575067e-01

MS_SubClassSplit_Foyer -0.42772154 6.688885e-01

MS_SubClassDuplex_All_Styles_and_Ages -4.12111836 3.885686e-05

MS_SubClassOne_Story_PUD_1946_and_Newer -3.45076120 5.677237e-04

MS_SubClassOne_and_Half_Story_PUD_All_Ages -1.28208457 1.999247e-01

MS_SubClassTwo_Story_PUD_1946_and_Newer -3.22100924 1.292808e-03

MS_SubClassPUD_Multilevel_Split_Level_Foyer -2.81367883 4.933814e-03

MS_SubClassTwo_Family_conversion_All_Styles_and_Ages -0.46715187 6.404295e-01

MS_ZoningResidential_High_Density 0.16017985 8.727516e-01

MS_ZoningResidential_Low_Density 0.06289203 9.498572e-01

MS_ZoningResidential_Medium_Density -0.65572785 5.120560e-01

MS_ZoningA_agr -0.42281505 6.724644e-01While many of these variables may have some relationship with the price of a house, we would like to identify the key variables, which have the biggest impact on the price of a house. We don’t want to claim that we will be able to find out the 4 or 5 variables that completely decide a price of a house, but we want to describe the data reasonably well with a model which we can interpret and potentially explain to others.

We will see several methods for selecting a subset of variables to use as our final regression model. We need a way to compare different models and so we will have several methods to determine a “good” model. These methods will compute different metrics and use them to decide whether to include a variable in the final model or not. One important point is to note how this differs from how we’ve done things previously. Before, we proposed a model and then fit that model. Once the regression residuals looked reasonable we could then interpret the model and do inference, such as tests and intervals for the coefficients. If we have not decided on our model in advance, inference for the coefficients is not valid. We cannot pick a model using the methods below and then test whether the coefficients are zero. We again run into problems related to multiple testing. We can interpret the coefficients, but only without statistical tests or confidence intervals.

Model Selection

We will now see some methods for choosing between models. There are many possible things you could do here, most of which are beyond the scope of this course. We will just highlight some possible tools.

We will consider:

All subsets regression

Backward Elimination

Forward Selection

Before we see these methods, we need to establish what metrics we will use to compare potential models.

Measures of Fit for Models

Previously we saw how \(R^2\) is not a reliable method for comparing models. To improve on this, we defined the adjusted \(R^2\), which accounts for the number of predictors in the model also. It will penalise models which add predictors which do not lead to a sufficient improvement in the variability of \(y\) described by the regression. Due to this penalty on the number of predictors in the model, if we compute \(R^2\) and \(R_{adj}^2\) for the same model, we will always have \(R_{adj}^2 < R^2\). We will now consider two more methods which have a similar goal to \(R_{adj}^2\).

The Akaike Information Criterion (AIC) accounts for the number of predictors in the model and prefers models which have smaller squared sums of errors. If we fit a model with \(p\) coefficients \(\beta_1,\beta_2,\ldots,\beta_p\) this model has sum of squares error \(SSError_{p}\), where we use \(p\) to denote a model with \(p\) coefficients. Then the AIC is defined as

\[ AIC = n\log(2\pi SSError_{p}/n) + n + 2p. \]

Note that this depends on \(n\), the number of observations in our dataset and also \(p\), the number of coefficients in our regression model. As we increase \(p\) the AIC will increase. As we increase \(n\), the first term may get smaller (as we divide by a larger number), while the second term, adding \(n\), will increase.

A very similar metric is known as the Bayesian Information Criterion (BIC) which is given by the formula

\[ BIC = n\log(2\pi SSError_{p}/n) + n + p\log n. \]

Note that the first two terms in AIC and BIC are identical, with the two formulas only differing on the last term. The first part, \(n\log(2\pi SSError_{p}/n)\) is something we try to minimise when fitting linear regression. It’s very similar and closely related to the least squares formula from Chapter 2. The final term is a penalty, and accounts for how complex the model is in terms of the number of coefficients \(p\) and/or the number of data points \(n\).

Unlike \(R_{adj}^2\), which we want to try get as close to 1 as possible, we want to minimize the AIC and the BIC. Increasing \(p\) will increase the AIC and BIC, and so unless increasing \(p\) leads to a sufficient reduction in \(n\log(2\pi SSError_{p}/n)\), we will have a higher AIC/BIC score, and a less desirable model.

\(R_{adj}^2\) is computed automatically when we run summary. For the AIC and BIC we need to run functions to compute these, AIC and BIC. Lets show these for some regression models we’ve seen before.

small_fit <- lm(body_mass_g ~ flipper_length_mm, data = penguins)

AIC(small_fit)[1] 5062.855BIC(small_fit)[1] 5074.359big_fit <- lm(body_mass_g ~ flipper_length_mm + bill_length_mm +

bill_depth_mm, data = penguins)

AIC(big_fit)[1] 5063.32BIC(big_fit)[1] 5082.494If we use AIC or BIC to compare these two models, we see that the simpler model is preferred by both metrics.

We can also see the \(R_{adj}^2\) for these two models.

summary(small_fit)$adj.r.squared[1] 0.7582837summary(big_fit)$adj.r.squared[1] 0.7593534Note that the more complex model, with an additional predictor gives a slightly larger value of \(R_{adj}^2\). So if we only used \(R_{adj}^2\), we would prefer the more complicated model.

In general, if we use AIC or BIC or \(R_{adj}^2\) to compare models, they won’t necessarily give the same answer. Its easy to look at the scores from each of these metrics. If two models appear similar, its probably better to choose the simpler of the two models. This will be easier to explain and will do almost as well.

Now that we have a few different tools for comparing models, lets see how we can select models.

All Subsets Regression

We said that we might have more than \(p=100\) predictors when we include categorical variables, but we want to choose a simpler model which describes the data well. All subsets regression considers all possible subsets of these predictors and tries to pick the best model, from all these possibilities. We will show what this means using an example.

Example

Suppose we have collected data where we have \(3\) numeric predictor variables. The most general model, with all of these predictors, would be

\[ Y = \beta_0 + \beta_1 X_1 + \beta_2 X_2 +\beta_3 X_3 +\epsilon. \]

We have \(p=3\) predictors \(X_1,X_2,X_3\). All subsets means all possible subsets of these predictors in our model (excluding interactions). For each of the predictors, it can either be in the model or not. This means there are \(2^p=8\) possible models when \(p=3\). To make this extra clear, all the possibilities are

\[ Y = \beta_0 + \epsilon \\ \] \[ Y = \beta_0 + \beta_1 X_1 +\epsilon \\ \] \[ Y = \beta_0 + \beta_1 X_2 +\epsilon \\ \] \[ Y = \beta_0 + \beta_1 X_3 +\epsilon \\ \] \[ Y = \beta_0 + \beta_1 X_1 + \beta_2 X_2 + \epsilon \\ \] \[ Y = \beta_0 + \beta_1 X_1 + \beta_2 X_3 + \epsilon \\ \] \[ Y = \beta_0 + \beta_1 X_2 + \beta_2 X_3 + \epsilon \\ \] \[ Y = \beta_0 + \beta_1 X_1 + \beta_2 X_2 +\beta_3 X_3 + \epsilon. \\ \]

Here the interpretation of the slope terms will change between these models, depending on which variables are actually in the model. We are using \(\beta_1\) for the first predictor in the model, \(\beta_2\) for the second and so on. All subsets regression will consider all these models and pick the best one. Note that this is reasonable if \(p\) is not very large. However, if we have \(p=50\) possible numeric predictors, that is over a quadrillion possible models! We cannot fit and compare all these models in any reasonable amount of time. Lets see an example of doing this with the penguin data, which has \(p=7\) possible predictors. Some of these are categorical, meaning we will need even more coefficients to incorporate them in a regression.

Recall that we can consider a model with all possible predictors in a dataset by using the notation lm(y ~., data), where . allows the use of all possible predictors.

We will consider all such models here and then identify the 10 best models, that is the 10 models which give the smallest BIC score. The lmSelect function in the package lmSubsets allows us to fit all these possible models.

library(lmSubsets)

lm_bic <- lmSelect(body_mass_g ~ ., data = penguins,

penalty = "BIC", nbest = 10)

lm_bicCall:

lmSelect(formula = body_mass_g ~ ., data = penguins, penalty = "BIC",

nbest = 10)

Criterion:

[best] = BIC

1st 2nd 3rd 4th 5th 6th 7th 8th

4752.472 4754.403 4755.232 4757.431 4758.279 4758.280 4759.567 4760.154

9th 10th

4760.231 4760.470

Subset:

best

+(Intercept) 1-10

speciesChinstrap 2-3,7-10

speciesGentoo 1-10

islandDream 4,8

islandTorgersen 5,7,10

bill_length_mm 2,6-9

bill_depth_mm 1-8,10

flipper_length_mm 1-10

sexmale 1-10 This gives quite a lot of different output, so we will explain the different components.

If we simply output lm_bic, this is an object which tells you about the best models and what variables they contain. The output tells you

The general linear regression model, under

call, similar to when we fit a single model.The

Criterion: gives us the BIC of the 10 best models, i.e the 10 smallest BIC scores, after fitting all \(2^p\) possible models.

Finally, the Subset: section goes through each of the possible predictors and identifies which of the 10 best models contain that predictor. For example, we see that all 10 of the best models contain Intercept,speciesGentoo,flipper_length_mm,sexmale, while islandDream is only included in the 4th and 8th best models.

Similarly, using the summary function on this gives some more useful output.

summary(lm_bic)Call:

lmSelect(formula = body_mass_g ~ ., data = penguins, penalty = "BIC",

nbest = 10)

Statistics:

SIZE BEST sigma R2 R2adj pval Cp AIC BIC

5 1 290.6573 0.8712718 0.8697020 < 2.22e-16 11.259976 4729.624 4752.472

7 2 287.3384 0.8749620 0.8726606 < 2.22e-16 5.678104 4723.938 4754.403

6 3 289.7720 0.8724449 0.8704945 < 2.22e-16 10.214035 4728.575 4755.232

6 4 290.7301 0.8716000 0.8696367 < 2.22e-16 12.407854 4730.774 4757.431

6 5 291.1007 0.8712725 0.8693041 < 2.22e-16 13.258404 4731.622 4758.279

6 6 291.1010 0.8712721 0.8693038 < 2.22e-16 13.259218 4731.623 4758.280

8 7 287.5016 0.8752038 0.8725159 < 2.22e-16 7.050099 4725.294 4759.567

8 8 287.7554 0.8749834 0.8722907 < 2.22e-16 7.622431 4725.881 4760.154

6 9 291.9553 0.8705155 0.8685356 < 2.22e-16 15.223959 4733.574 4760.231

7 10 289.9678 0.8726630 0.8703194 < 2.22e-16 11.647611 4730.005 4760.470Here for each of the 10 best models we get

Size: the number of predictors \(p\)Best: Where this specific model ranks in the best models in terms of BICsigma: An estimate of the residual standard errorR2: The \(R^2\) for that modelR2adj: The adjusted \(R^2\) for that modelpval: The p-Value for an \(F\)-test of \(H_0:\beta_1=\beta_2=\ldots=\beta_p=0\)Cp: Another metric we could use to compare models, which we don’t discuss in this class (and has a slightly different interpretation).AIC: The AIC for each of these models.BIC: The BIC for each of these models.